Page 377 - Bank-Muamalat-Annual-Report-2021

P. 377

ANNUAL REPORT 2021 375

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

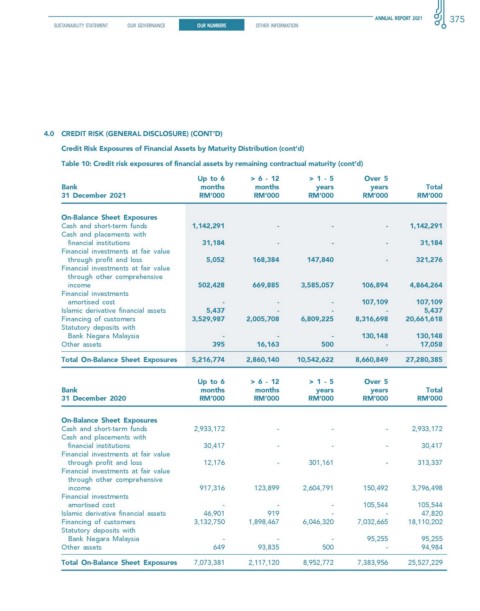

4.0 creDIT rIsK (generAl DIsclosure) (conT’D)

credit risk exposures of financial Assets by Maturity Distribution (cont’d)

Table 10: credit risk exposures of financial assets by remaining contractual maturity (cont’d)

up to 6 > 6 - 12 > 1 - 5 over 5

Bank months months years years Total

31 December 2021 rM’000 rM’000 rM’000 rM’000 rM’000

on-Balance sheet exposures

Cash and short-term funds 1,142,291 - - - 1,142,291

Cash and placements with

financial institutions 31,184 - - - 31,184

Financial investments at fair value

through profit and loss 5,052 168,384 147,840 - 321,276

Financial investments at fair value

through other comprehensive

income 502,428 669,885 3,585,057 106,894 4,864,264

Financial investments

amortised cost - - - 107,109 107,109

Islamic derivative financial assets 5,437 - - - 5,437

Financing of customers 3,529,987 2,005,708 6,809,225 8,316,698 20,661,618

Statutory deposits with

Bank Negara Malaysia - - - 130,148 130,148

Other assets 395 16,163 500 - 17,058

Total on-Balance sheet exposures 5,216,774 2,860,140 10,542,622 8,660,849 27,280,385

up to 6 > 6 - 12 > 1 - 5 over 5

Bank months months years years Total

31 December 2020 rM’000 rM’000 rM’000 rM’000 rM’000

on-Balance sheet exposures

Cash and short-term funds 2,933,172 - - - 2,933,172

Cash and placements with

financial institutions 30,417 - - - 30,417

Financial investments at fair value

through profit and loss 12,176 - 301,161 - 313,337

Financial investments at fair value

through other comprehensive

income 917,316 123,899 2,604,791 150,492 3,796,498

Financial investments

amortised cost - - - 105,544 105,544

Islamic derivative financial assets 46,901 919 - - 47,820

Financing of customers 3,132,750 1,898,467 6,046,320 7,032,665 18,110,202

Statutory deposits with

Bank Negara Malaysia - - - 95,255 95,255

Other assets 649 93,835 500 - 94,984

Total on-Balance sheet exposures 7,073,381 2,117,120 8,952,772 7,383,956 25,527,229