Page 381 - Bank-Muamalat-Annual-Report-2021

P. 381

ANNUAL REPORT 2021 379

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

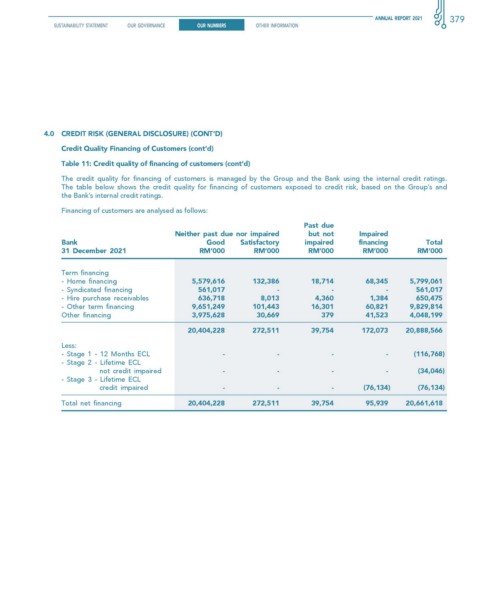

4.0 creDIT rIsK (generAl DIsclosure) (conT’D)

credit quality financing of customers (cont’d)

Table 11: credit quality of financing of customers (cont’d)

The credit quality for financing of customers is managed by the Group and the Bank using the internal credit ratings.

The table below shows the credit quality for financing of customers exposed to credit risk, based on the Group’s and

the Bank’s internal credit ratings.

Financing of customers are analysed as follows:

Past due

neither past due nor impaired but not Impaired

Bank good satisfactory impaired financing Total

31 December 2021 rM’000 rM’000 rM’000 rM’000 rM’000

Term financing

- Home financing 5,579,616 132,386 18,714 68,345 5,799,061

- Syndicated financing 561,017 - - - 561,017

- Hire purchase receivables 636,718 8,013 4,360 1,384 650,475

- Other term financing 9,651,249 101,443 16,301 60,821 9,829,814

Other financing 3,975,628 30,669 379 41,523 4,048,199

20,404,228 272,511 39,754 172,073 20,888,566

Less:

- Stage 1 - 12 Months ECL - - - - (116,768)

- Stage 2 - Lifetime ECL

not credit impaired - - - - (34,046)

- Stage 3 - Lifetime ECL

credit impaired - - - (76,134) (76,134)

Total net financing 20,404,228 272,511 39,754 95,939 20,661,618