Page 380 - Bank-Muamalat-Annual-Report-2021

P. 380

378 BANK MUAMALAT MALAYSIA BERHAD

OUR PERFORMANCE

ABOUT US

OUR LEADERSHIP

OUR STRATEGY

ABOUT US OUR LEADERSHIP OUR STRA TEGY OUR PERFORMANCE

BASEL II

PILLAR 3 DISCLOSURE

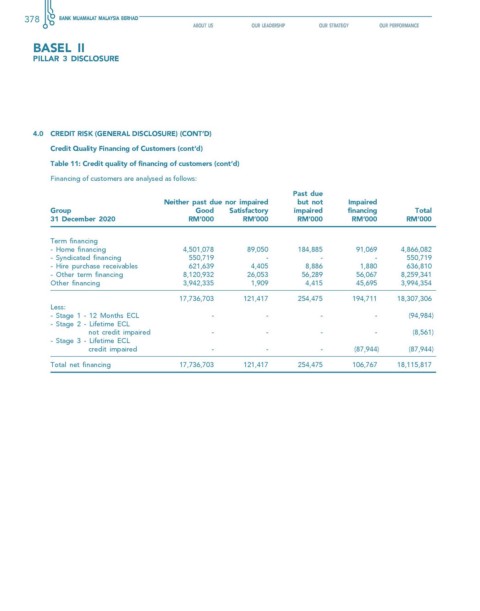

4.0 creDIT rIsK (generAl DIsclosure) (conT’D)

credit quality financing of customers (cont’d)

Table 11: credit quality of financing of customers (cont’d)

Financing of customers are analysed as follows:

Past due

neither past due nor impaired but not Impaired

group good satisfactory impaired financing Total

31 December 2020 rM’000 rM’000 rM’000 rM’000 rM’000

Term financing

- Home financing 4,501,078 89,050 184,885 91,069 4,866,082

- Syndicated financing 550,719 - - - 550,719

- Hire purchase receivables 621,639 4,405 8,886 1,880 636,810

- Other term financing 8,120,932 26,053 56,289 56,067 8,259,341

Other financing 3,942,335 1,909 4,415 45,695 3,994,354

17,736,703 121,417 254,475 194,711 18,307,306

Less:

- Stage 1 - 12 Months ECL - - - - (94,984)

- Stage 2 - Lifetime ECL

not credit impaired - - - - (8,561)

- Stage 3 - Lifetime ECL

credit impaired - - - (87,944) (87,944)

Total net financing 17,736,703 121,417 254,475 106,767 18,115,817