Page 386 - Bank-Muamalat-Annual-Report-2021

P. 386

384 BANK MUAMALAT MALAYSIA BERHAD

OUR LEADERSHIP

ABOUT US

ABOUT US OUR LEADERSHIP OUR STRA TEGY OUR PERFORMANCE

OUR STRATEGY

OUR PERFORMANCE

BASEL II

PILLAR 3 DISCLOSURE

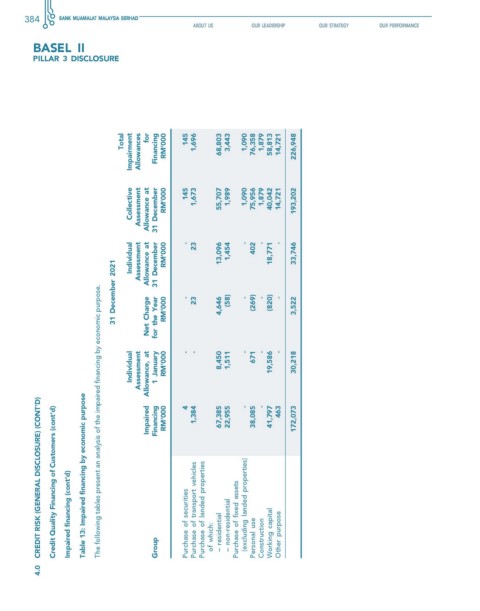

Impairment Allowances financing 226,948

Total for rM’000 145 1,696 68,803 3,443 1,090 76,358 1,879 58,813 14,721

collective Assessment Allowance at 31 December rM’000 145 1,673 55,707 1,989 1,090 75,956 1,879 40,042 14,721 193,202

Individual Assessment Allowance at 31 December rM’000 - 23 13,096 1,454 - 402 - 18,771 - 33,746

31 December 2021 net charge for the year rM’000 - 23 4,646 (58) - (269) - (820) - 3,522

The following tables present an analysis of the impaired financing by economic purpose.

Individual Assessment Allowance, at 1 January rM’000 - - 8,450 1,511 - 671 - 19,586 - 30,218

creDIT rIsK (generAl DIsclosure) (conT’D)

Impaired financing rM’000 4 1,384 67,385 22,955 - 38,085 - 41,797 463 172,073

credit quality financing of customers (cont’d)

Impaired financing (cont’d) Table 13: Impaired financing by economic purpose Purchase of securities Purchase of transport vehicles Purchase of landed properties of which: – residential – non-residential Purchase of fixed assets (excluding landed properties) Personal use Construction Working capital Other purpose

4.0 group