Page 372 - Bank-Muamalat-Annual-Report-2021

P. 372

370 BANK MUAMALAT MALAYSIA BERHAD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

OUR LEADERSHIP

ABOUT US

TEGY

OUR PERFORMANCE

OUR STRA

BASEL II

PILLAR 3 DISCLOSURE

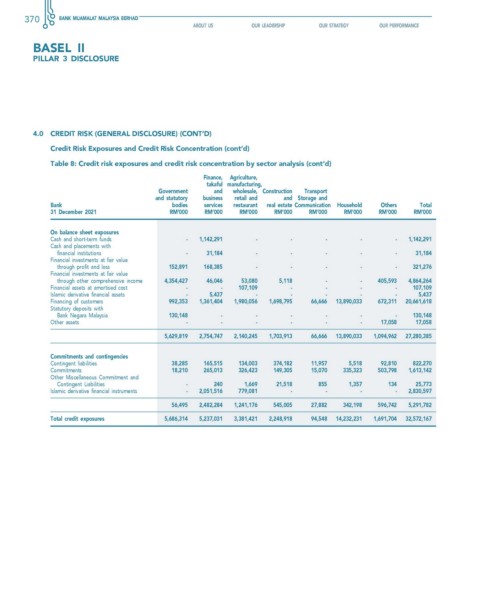

4.0 creDIT rIsK (generAl DIsclosure) (conT’D)

credit risk exposures and credit risk concentration (cont’d)

Table 8: credit risk exposures and credit risk concentration by sector analysis (cont’d)

finance, Agriculture,

takaful manufacturing,

government and wholesale, construction Transport

and statutory business retail and and storage and

Bank bodies services restaurant real estate communication household others Total

31 December 2021 rM’000 rM’000 rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

on balance sheet exposures

Cash and short-term funds - 1,142,291 - - - - - 1,142,291

Cash and placements with

financial institutions - 31,184 - - - - - 31,184

Financial investments at fair value

through profit and loss 152,891 168,385 - - - - - 321,276

Financial investments at fair value

through other comprehensive income 4,354,427 46,046 53,080 5,118 - - 405,593 4,864,264

Financial assets at amortised cost - - 107,109 - - - - 107,109

Islamic derivative financial assets - 5,437 - - - - - 5,437

Financing of customers 992,353 1,361,404 1,980,056 1,698,795 66,666 13,890,033 672,311 20,661,618

Statutory deposits with

Bank Negara Malaysia 130,148 - - - - - - 130,148

Other assets - - - - - - 17,058 17,058

5,629,819 2,754,747 2,140,245 1,703,913 66,666 13,890,033 1,094,962 27,280,385

commitments and contingencies

Contingent liabilities 38,285 165,515 134,003 374,182 11,957 5,518 92,810 822,270

Commitments 18,210 265,013 326,423 149,305 15,070 335,323 503,798 1,613,142

Other Miscellaneous Commitment and

Contingent Liabilities - 240 1,669 21,518 855 1,357 134 25,773

Islamic derivative financial instruments - 2,051,516 779,081 - - - - 2,830,597

56,495 2,482,284 1,241,176 545,005 27,882 342,198 596,742 5,291,782

Total credit exposures 5,686,314 5,237,031 3,381,421 2,248,918 94,548 14,232,231 1,691,704 32,572,167