Page 284 - Bank-Muamalat-Annual-Report-2021

P. 284

282 bank MuaMalat Malaysia berhaD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

46. fINANcIAL RIsk MANAGeMeNT OBJecTIves AND POLIcIes (cONT’D.)

Risk governance (cont’d.)

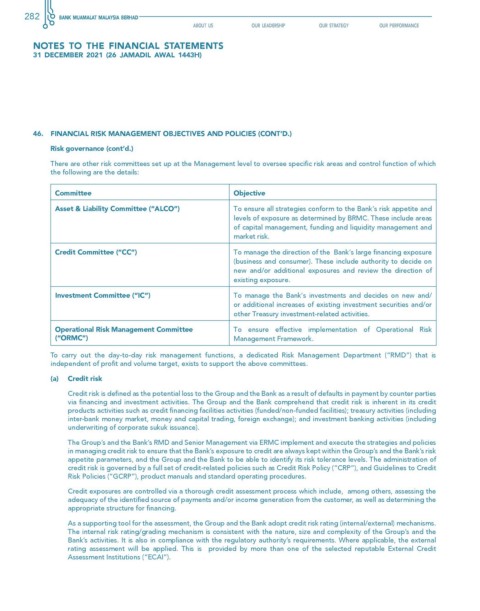

There are other risk committees set up at the Management level to oversee specific risk areas and control function of which

the following are the details:

committee Objective

Asset & Liability committee (“ALcO”) To ensure all strategies conform to the Bank’s risk appetite and

levels of exposure as determined by BRMC. These include areas

of capital management, funding and liquidity management and

market risk.

credit committee (“cc”) To manage the direction of the Bank’s large financing exposure

(business and consumer). These include authority to decide on

new and/or additional exposures and review the direction of

existing exposure.

Investment committee (“Ic”) To manage the Bank’s investments and decides on new and/

or additional increases of existing investment securities and/or

other Treasury investment-related activities.

Operational Risk Management committee To ensure effective implementation of Operational Risk

(“ORMc”) Management Framework.

To carry out the day-to-day risk management functions, a dedicated Risk Management Department (“RMD”) that is

independent of profit and volume target, exists to support the above committees.

(a) credit risk

Credit risk is defined as the potential loss to the Group and the Bank as a result of defaults in payment by counter parties

via financing and investment activities. The Group and the Bank comprehend that credit risk is inherent in its credit

products activities such as credit financing facilities activities (funded/non-funded facilities); treasury activities (including

inter-bank money market, money and capital trading, foreign exchange); and investment banking activities (including

underwriting of corporate sukuk issuance).

The Group’s and the Bank’s RMD and Senior Management via ERMC implement and execute the strategies and policies

in managing credit risk to ensure that the Bank’s exposure to credit are always kept within the Group’s and the Bank’s risk

appetite parameters, and the Group and the Bank to be able to identify its risk tolerance levels. The administration of

credit risk is governed by a full set of credit-related policies such as Credit Risk Policy (“CRP”), and Guidelines to Credit

Risk Policies (“GCRP”), product manuals and standard operating procedures.

Credit exposures are controlled via a thorough credit assessment process which include, among others, assessing the

adequacy of the identified source of payments and/or income generation from the customer, as well as determining the

appropriate structure for financing.

As a supporting tool for the assessment, the Group and the Bank adopt credit risk rating (internal/external) mechanisms.

The internal risk rating/grading mechanism is consistent with the nature, size and complexity of the Group’s and the

Bank’s activities. It is also in compliance with the regulatory authority’s requirements. Where applicable, the external

rating assessment will be applied. This is provided by more than one of the selected reputable External Credit

Assessment Institutions (“ECAI”).