Page 281 - Bank-Muamalat-Annual-Report-2021

P. 281

ANNUAL REPORT 2021 279

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

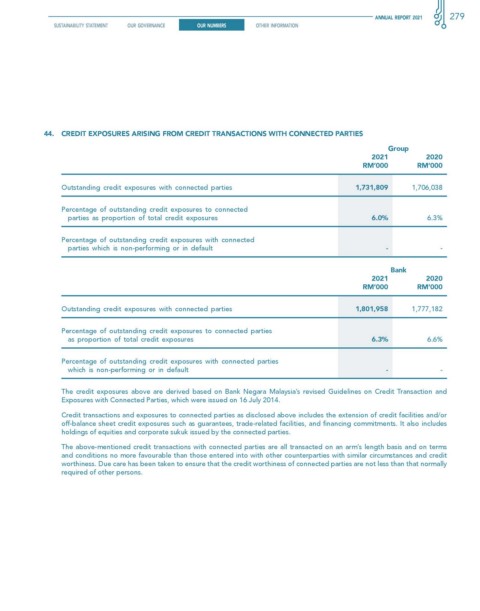

44. cReDIT exPOsuRes ARIsING fROM cReDIT TRANsAcTIONs wITh cONNecTeD PARTIes

Group

2021 2020

rM’000 rM’000

Outstanding credit exposures with connected parties 1,731,809 1,706,038

Percentage of outstanding credit exposures to connected

parties as proportion of total credit exposures 6.0% 6.3%

Percentage of outstanding credit exposures with connected

parties which is non-performing or in default - -

Bank

2021 2020

rM’000 rM’000

Outstanding credit exposures with connected parties 1,801,958 1,777,182

Percentage of outstanding credit exposures to connected parties

as proportion of total credit exposures 6.3% 6.6%

Percentage of outstanding credit exposures with connected parties

which is non-performing or in default - -

The credit exposures above are derived based on Bank Negara Malaysia’s revised Guidelines on Credit Transaction and

Exposures with Connected Parties, which were issued on 16 July 2014.

Credit transactions and exposures to connected parties as disclosed above includes the extension of credit facilities and/or

off-balance sheet credit exposures such as guarantees, trade-related facilities, and financing commitments. It also includes

holdings of equities and corporate sukuk issued by the connected parties.

The above-mentioned credit transactions with connected parties are all transacted on an arm’s length basis and on terms

and conditions no more favourable than those entered into with other counterparties with similar circumstances and credit

worthiness. Due care has been taken to ensure that the credit worthiness of connected parties are not less than that normally

required of other persons.