Page 278 - Bank-Muamalat-Annual-Report-2021

P. 278

276 bank MuaMalat Malaysia berhaD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

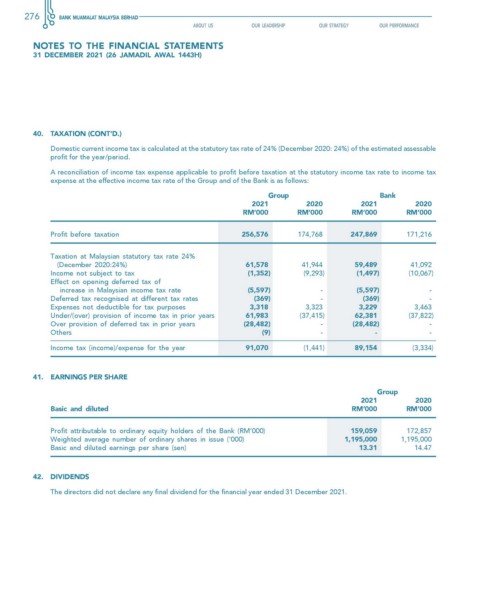

40. TAxATION (cONT’D.)

Domestic current income tax is calculated at the statutory tax rate of 24% (December 2020: 24%) of the estimated assessable

profit for the year/period.

A reconciliation of income tax expense applicable to profit before taxation at the statutory income tax rate to income tax

expense at the effective income tax rate of the Group and of the Bank is as follows:

Group Bank

2021 2020 2021 2020

rM’000 rM’000 rM’000 rM’000

Profit before taxation 256,576 174,768 247,869 171,216

Taxation at Malaysian statutory tax rate 24%

(December 2020:24%) 61,578 41,944 59,489 41,092

Income not subject to tax (1,352) (9,293) (1,497) (10,067)

Effect on opening deferred tax of

increase in Malaysian income tax rate (5,597) - (5,597) -

Deferred tax recognised at different tax rates (369) - (369) -

Expenses not deductible for tax purposes 3,318 3,323 3,229 3,463

Under/(over) provision of income tax in prior years 61,983 (37,415) 62,381 (37,822)

Over provision of deferred tax in prior years (28,482) - (28,482) -

Others (9) - - -

Income tax (income)/expense for the year 91,070 (1,441) 89,154 (3,334)

41. eARNINGs PeR shARe

Group

2021 2020

Basic and diluted RM’000 RM’000

Profit attributable to ordinary equity holders of the Bank (RM’000) 159,059 172,857

Weighted average number of ordinary shares in issue (‘000) 1,195,000 1,195,000

Basic and diluted earnings per share (sen) 13.31 14.47

42. DIvIDeNDs

The directors did not declare any final dividend for the financial year ended 31 December 2021.