Page 279 - Bank-Muamalat-Annual-Report-2021

P. 279

ANNUAL REPORT 2021 277

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

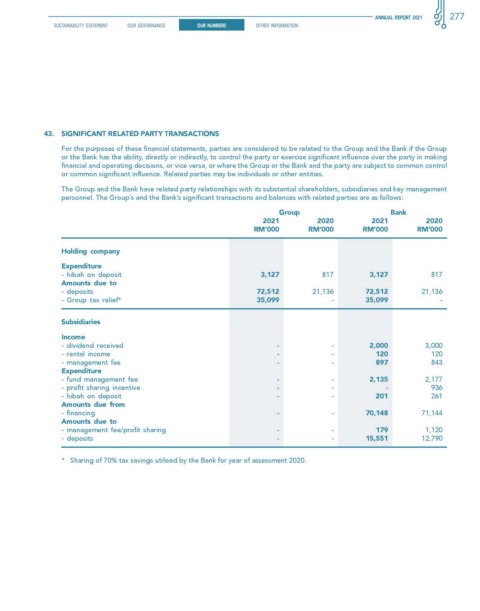

43. sIGNIfIcANT ReLATeD PARTy TRANsAcTIONs

For the purposes of these financial statements, parties are considered to be related to the Group and the Bank if the Group

or the Bank has the ability, directly or indirectly, to control the party or exercise significant influence over the party in making

financial and operating decisions, or vice versa, or where the Group or the Bank and the party are subject to common control

or common significant influence. Related parties may be individuals or other entities.

The Group and the Bank have related party relationships with its substantial shareholders, subsidiaries and key management

personnel. The Group’s and the Bank’s significant transactions and balances with related parties are as follows:

Group Bank

2021 2020 2021 2020

rM’000 rM’000 rM’000 rM’000

holding company

expenditure

- hibah on deposit 3,127 817 3,127 817

Amounts due to

- deposits 72,512 21,136 72,512 21,136

- Group tax relief* 35,099 - 35,099 -

subsidiaries

Income

- dividend received - - 2,000 3,000

- rental income - - 120 120

- management fee - - 897 843

expenditure

- fund management fee - - 2,135 2,177

- profit sharing incentive - - - 936

- hibah on deposit - - 201 261

Amounts due from

- financing - - 70,148 71,144

Amounts due to

- management fee/profit sharing - - 179 1,120

- deposits - - 15,551 12,790

* Sharing of 70% tax savings utilised by the Bank for year of assessment 2020.