Page 263 - Bank-Muamalat-Annual-Report-2021

P. 263

ANNUAL REPORT 2021 261

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

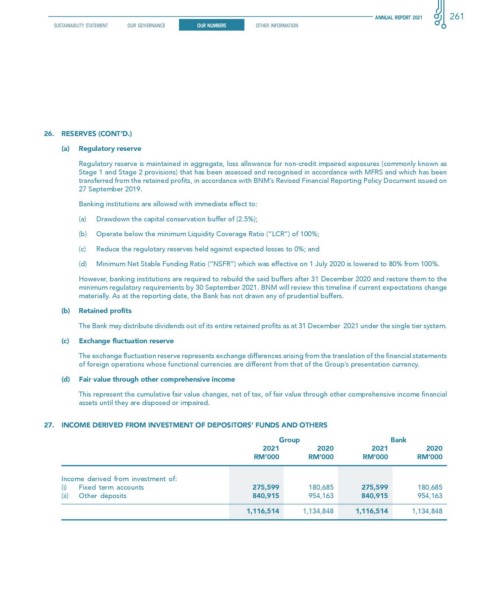

26. ReseRves (cONT’D.)

(a) Regulatory reserve

Regulatory reserve is maintained in aggregate, loss allowance for non-credit impaired exposures (commonly known as

Stage 1 and Stage 2 provisions) that has been assessed and recognised in accordance with MFRS and which has been

transferred from the retained profits, in accordance with BNM’s Revised Financial Reporting Policy Document issued on

27 September 2019.

Banking institutions are allowed with immediate effect to:

(a) Drawdown the capital conservation buffer of (2.5%);

(b) Operate below the minimum Liquidity Coverage Ratio (“LCR”) of 100%;

(c) Reduce the regulotary reserves held against expected losses to 0%; and

(d) Minimum Net Stable Funding Ratio (“NSFR”) which was effective on 1 July 2020 is lowered to 80% from 100%.

However, banking institutions are required to rebuild the said buffers after 31 December 2020 and restore them to the

minimum regulatory requirements by 30 September 2021. BNM will review this timeline if current expectations change

materially. As at the reporting date, the Bank has not drawn any of prudential buffers.

(b) Retained profits

The Bank may distribute dividends out of its entire retained profits as at 31 December 2021 under the single tier system.

(c) exchange fluctuation reserve

The exchange fluctuation reserve represents exchange differences arising from the translation of the financial statements

of foreign operations whose functional currencies are different from that of the Group’s presentation currency.

(d) fair value through other comprehensive income

This represent the cumulative fair value changes, net of tax, of fair value through other comprehensive income financial

assets until they are disposed or impaired.

27. INcOMe DeRIveD fROM INvesTMeNT Of DePOsITORs’ fuNDs AND OTheRs

Group Bank

2021 2020 2021 2020

rM’000 rM’000 rM’000 rM’000

Income derived from investment of:

(i) Fixed term accounts 275,599 180,685 275,599 180,685

(ii) Other deposits 840,915 954,163 840,915 954,163

1,116,514 1,134,848 1,116,514 1,134,848