Page 266 - Bank-Muamalat-Annual-Report-2021

P. 266

264 bank MuaMalat Malaysia berhaD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

27. INcOMe DeRIveD fROM INvesTMeNT Of DePOsITORs’ fuNDs AND OTheRs (cONT’D.)

(ii) Income derived from investment of other deposits (cont’d.)

(a) During the financial year, the Group and the Bank continue with granting targeted payment assistance and

moratorium 2.0.

This measure was to assist customers experiencing temporary financial constraints due to the COVID-19

pandemic. As a result of the payment moratorium, the Group and the Bank recognised a loss of RM9,645,841

(2020: RM46,212,464), arising from the modification of contractual cash flows of financing. This amount is netted

off against income from financing.

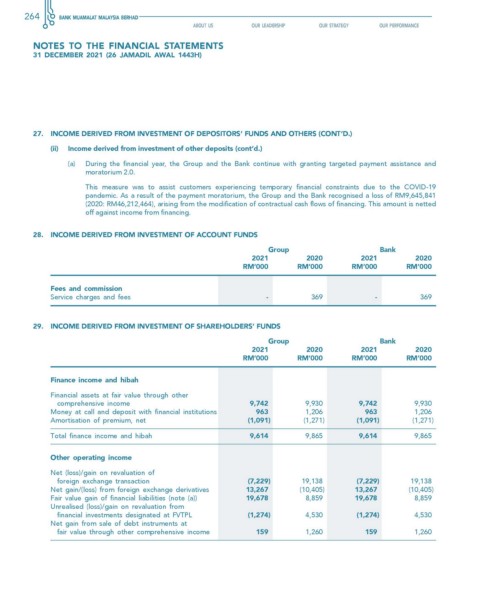

28. INcOMe DeRIveD fROM INvesTMeNT Of AccOuNT fuNDs

Group Bank

2021 2020 2021 2020

rM’000 rM’000 rM’000 rM’000

fees and commission

Service charges and fees - 369 - 369

29. INcOMe DeRIveD fROM INvesTMeNT Of shARehOLDeRs’ fuNDs

Group Bank

2021 2020 2021 2020

rM’000 rM’000 rM’000 rM’000

finance income and hibah

Financial assets at fair value through other

comprehensive income 9,742 9,930 9,742 9,930

Money at call and deposit with financial institutions 963 1,206 963 1,206

Amortisation of premium, net (1,091) (1,271) (1,091) (1,271)

Total finance income and hibah 9,614 9,865 9,614 9,865

Other operating income

Net (loss)/gain on revaluation of

foreign exchange transaction (7,229) 19,138 (7,229) 19,138

Net gain/(loss) from foreign exchange derivatives 13,267 (10,405) 13,267 (10,405)

Fair value gain of financial liabilities (note (a)) 19,678 8,859 19,678 8,859

Unrealised (loss)/gain on revaluation from

financial investments designated at FVTPL (1,274) 4,530 (1,274) 4,530

Net gain from sale of debt instruments at

fair value through other comprehensive income 159 1,260 159 1,260