Page 264 - Bank-Muamalat-Annual-Report-2021

P. 264

262 bank MuaMalat Malaysia berhaD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

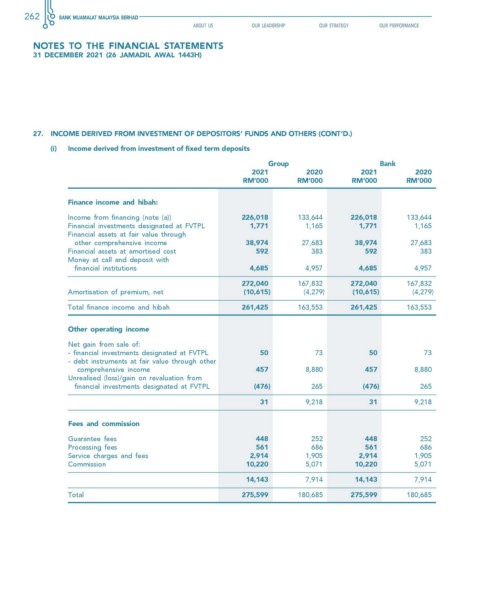

27. INcOMe DeRIveD fROM INvesTMeNT Of DePOsITORs’ fuNDs AND OTheRs (cONT’D.)

(i) Income derived from investment of fixed term deposits

Group Bank

2021 2020 2021 2020

rM’000 rM’000 rM’000 rM’000

finance income and hibah:

Income from financing (note (a)) 226,018 133,644 226,018 133,644

Financial investments designated at FVTPL 1,771 1,165 1,771 1,165

Financial assets at fair value through

other comprehensive income 38,974 27,683 38,974 27,683

Financial assets at amortised cost 592 383 592 383

Money at call and deposit with

financial institutions 4,685 4,957 4,685 4,957

272,040 167,832 272,040 167,832

Amortisation of premium, net (10,615) (4,279) (10,615) (4,279)

Total finance income and hibah 261,425 163,553 261,425 163,553

Other operating income

Net gain from sale of:

- financial investments designated at FVTPL 50 73 50 73

- debt instruments at fair value through other

comprehensive income 457 8,880 457 8,880

Unrealised (loss)/gain on revaluation from

financial investments designated at FVTPL (476) 265 (476) 265

31 9,218 31 9,218

fees and commission

Guarantee fees 448 252 448 252

Processing fees 561 686 561 686

Service charges and fees 2,914 1,905 2,914 1,905

Commission 10,220 5,071 10,220 5,071

14,143 7,914 14,143 7,914

Total 275,599 180,685 275,599 180,685