Page 267 - Bank-Muamalat-Annual-Report-2021

P. 267

ANNUAL REPORT 2021 265

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

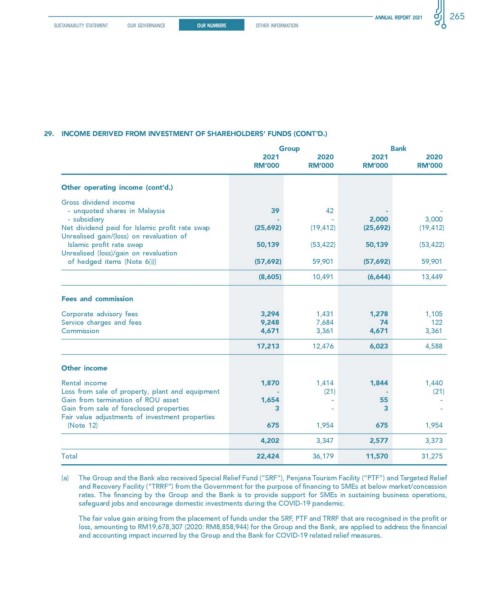

29. INcOMe DeRIveD fROM INvesTMeNT Of shARehOLDeRs’ fuNDs (cONT’D.)

Group Bank

2021 2020 2021 2020

rM’000 rM’000 rM’000 rM’000

Other operating income (cont’d.)

Gross dividend income

- unquoted shares in Malaysia 39 42 - -

- subsidiary - - 2,000 3,000

Net dividend paid for Islamic profit rate swap (25,692) (19,412) (25,692) (19,412)

Unrealised gain/(loss) on revaluation of

Islamic profit rate swap 50,139 (53,422) 50,139 (53,422)

Unrealised (loss)/gain on revaluation

of hedged items (Note 6(i)) (57,692) 59,901 (57,692) 59,901

(8,605) 10,491 (6,644) 13,449

fees and commission

Corporate advisory fees 3,294 1,431 1,278 1,105

Service charges and fees 9,248 7,684 74 122

Commission 4,671 3,361 4,671 3,361

17,213 12,476 6,023 4,588

Other income

Rental income 1,870 1,414 1,844 1,440

Loss from sale of property, plant and equipment - (21) - (21)

Gain from termination of ROU asset 1,654 - 55 -

Gain from sale of foreclosed properties 3 - 3 -

Fair value adjustments of investment properties

(Note 12) 675 1,954 675 1,954

4,202 3,347 2,577 3,373

Total 22,424 36,179 11,570 31,275

(a) The Group and the Bank also received Special Relief Fund (“SRF”), Penjana Tourism Facility (“PTF”) and Targeted Relief

and Recovery Facility (“TRRF”) from the Government for the purpose of financing to SMEs at below market/concession

rates. The financing by the Group and the Bank is to provide support for SMEs in sustaining business operations,

safeguard jobs and encourage domestic investments during the COVID-19 pandemic.

The fair value gain arising from the placement of funds under the SRF, PTF and TRRF that are recognised in the profit or

loss, amounting to RM19,678,307 (2020: RM8,858,944) for the Group and the Bank, are applied to address the financial

and accounting impact incurred by the Group and the Bank for COVID-19 related relief measures.