Page 265 - Bank-Muamalat-Annual-Report-2021

P. 265

ANNUAL REPORT 2021 263

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

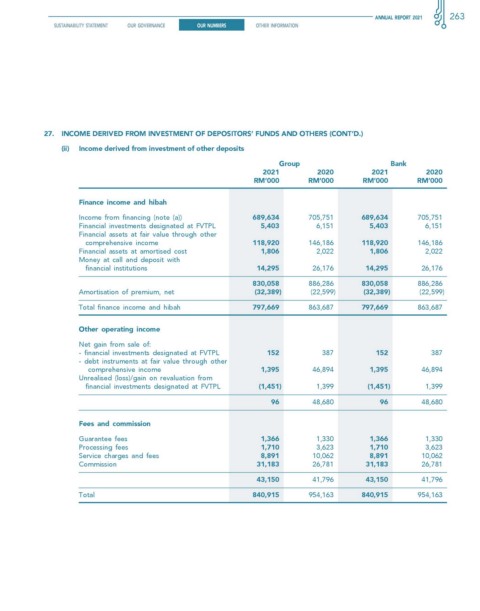

27. INcOMe DeRIveD fROM INvesTMeNT Of DePOsITORs’ fuNDs AND OTheRs (cONT’D.)

(ii) Income derived from investment of other deposits

Group Bank

2021 2020 2021 2020

rM’000 rM’000 rM’000 rM’000

finance income and hibah

Income from financing (note (a)) 689,634 705,751 689,634 705,751

Financial investments designated at FVTPL 5,403 6,151 5,403 6,151

Financial assets at fair value through other

comprehensive income 118,920 146,186 118,920 146,186

Financial assets at amortised cost 1,806 2,022 1,806 2,022

Money at call and deposit with

financial institutions 14,295 26,176 14,295 26,176

830,058 886,286 830,058 886,286

Amortisation of premium, net (32,389) (22,599) (32,389) (22,599)

Total finance income and hibah 797,669 863,687 797,669 863,687

Other operating income

Net gain from sale of:

- financial investments designated at FVTPL 152 387 152 387

- debt instruments at fair value through other

comprehensive income 1,395 46,894 1,395 46,894

Unrealised (loss)/gain on revaluation from

financial investments designated at FVTPL (1,451) 1,399 (1,451) 1,399

96 48,680 96 48,680

fees and commission

Guarantee fees 1,366 1,330 1,366 1,330

Processing fees 1,710 3,623 1,710 3,623

Service charges and fees 8,891 10,062 8,891 10,062

Commission 31,183 26,781 31,183 26,781

43,150 41,796 43,150 41,796

Total 840,915 954,163 840,915 954,163