Page 258 - Bank-Muamalat-Annual-Report-2021

P. 258

256 bank MuaMalat Malaysia berhaD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

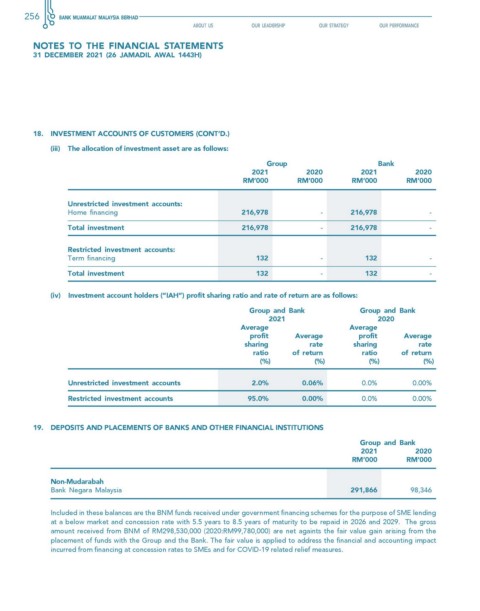

18. INvesTMeNT AccOuNTs Of cusTOMeRs (cONT’D.)

(iii) The allocation of investment asset are as follows:

Group Bank

2021 2020 2021 2020

rM’000 rM’000 rM’000 rM’000

unrestricted investment accounts:

Home financing 216,978 - 216,978 -

Total investment 216,978 - 216,978 -

Restricted investment accounts:

Term financing 132 - 132 -

Total investment 132 - 132 -

(iv) Investment account holders (“IAh”) profit sharing ratio and rate of return are as follows:

Group and Bank Group and Bank

2021 2020

Average Average

profit Average profit Average

sharing rate sharing rate

ratio of return ratio of return

(%) (%) (%) (%)

unrestricted investment accounts 2.0% 0.06% 0.0% 0.00%

Restricted investment accounts 95.0% 0.00% 0.0% 0.00%

19. DePOsITs AND PLAceMeNTs Of BANks AND OTheR fINANcIAL INsTITuTIONs

Group and Bank

2021 2020

rM’000 rM’000

Non-Mudarabah

Bank Negara Malaysia 291,866 98,346

Included in these balances are the BNM funds received under government financing schemes for the purpose of SME lending

at a below market and concession rate with 5.5 years to 8.5 years of maturity to be repaid in 2026 and 2029. The gross

amount received from BNM of RM298,530,000 (2020:RM99,780,000) are net againts the fair value gain arising from the

placement of funds with the Group and the Bank. The fair value is applied to address the financial and accounting impact

incurred from financing at concession rates to SMEs and for COVID-19 related relief measures.