Page 343 - Bank-Muamalat-AR2020

P. 343

341

Our Performance Sustainability Statement Governance Our Numbers Other Information

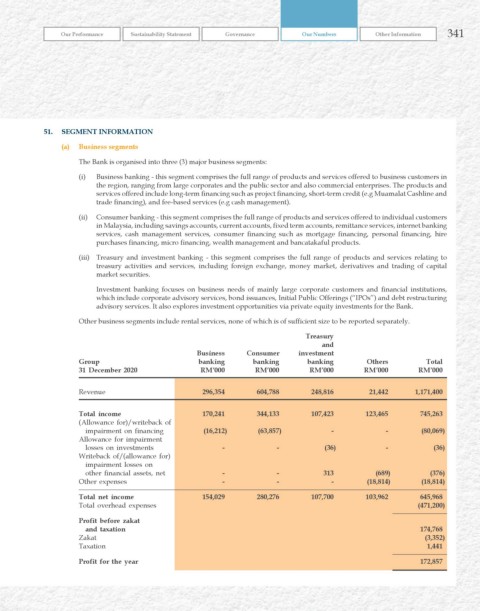

51. SEGMENT INFOrMATION

(a) Business segments

The Bank is organised into three (3) major business segments:

(i) Business banking - this segment comprises the full range of products and services offered to business customers in

the region, ranging from large corporates and the public sector and also commercial enterprises. The products and

services offered include long-term financing such as project financing, short-term credit (e.g Muamalat Cashline and

trade financing), and fee-based services (e.g cash management).

(ii) Consumer banking - this segment comprises the full range of products and services offered to individual customers

in Malaysia, including savings accounts, current accounts, fixed term accounts, remittance services, internet banking

services, cash management services, consumer financing such as mortgage financing, personal financing, hire

purchases financing, micro financing, wealth management and bancatakaful products.

(iii) Treasury and investment banking - this segment comprises the full range of products and services relating to

treasury activities and services, including foreign exchange, money market, derivatives and trading of capital

market securities.

Investment banking focuses on business needs of mainly large corporate customers and financial institutions,

which include corporate advisory services, bond issuances, Initial Public Offerings (“IPOs”) and debt restructuring

advisory services. It also explores investment opportunities via private equity investments for the Bank.

Other business segments include rental services, none of which is of sufficient size to be reported separately.

Treasury

and

Business Consumer investment

Group banking banking banking Others Total

31 December 2020 rM’000 rM’000 rM’000 rM’000 rM’000

Revenue 296,354 604,788 248,816 21,442 1,171,400

Total income 170,241 344,133 107,423 123,465 745,263

(Allowance for)/writeback of

impairment on financing (16,212) (63,857) - - (80,069)

Allowance for impairment

losses on investments - - (36) - (36)

Writeback of/(allowance for)

impairment losses on

other financial assets, net - - 313 (689) (376)

Other expenses - - - (18,814) (18,814)

Total net income 154,029 280,276 107,700 103,962 645,968

Total overhead expenses (471,200)

Profit before zakat

and taxation 174,768

Zakat (3,352)

Taxation 1,441

Profit for the year 172,857