Page 341 - Bank-Muamalat-AR2020

P. 341

339

Our Performance Sustainability Statement Governance Our Numbers Other Information

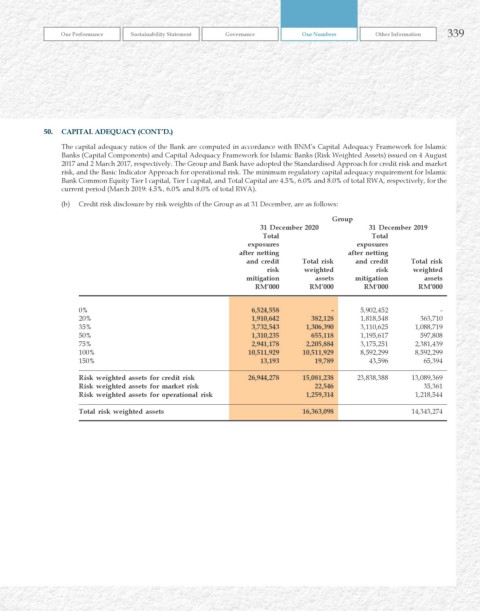

50. CAPITAL ADEquACy (CONT’D.)

The capital adequacy ratios of the Bank are computed in accordance with BNM’s Capital Adequacy Framework for Islamic

Banks (Capital Components) and Capital Adequacy Framework for Islamic Banks (Risk Weighted Assets) issued on 4 August

2017 and 2 March 2017, respectively. The Group and Bank have adopted the Standardised Approach for credit risk and market

risk, and the Basic Indicator Approach for operational risk. The minimum regulatory capital adequacy requirement for Islamic

Bank Common Equity Tier I capital, Tier I capital, and Total Capital are 4.5%, 6.0% and 8.0% of total RWA, respectively, for the

current period (March 2019: 4.5%, 6.0% and 8.0% of total RWA).

(b) Credit risk disclosure by risk weights of the Group as at 31 December, are as follows:

Group

31 December 2020 31 December 2019

Total Total

exposures exposures

after netting after netting

and credit Total risk and credit Total risk

risk weighted risk weighted

mitigation assets mitigation assets

rM’000 rM’000 rM’000 rM’000

0% 6,524,558 - 5,902,452 -

20% 1,910,642 382,128 1,818,548 363,710

35% 3,732,543 1,306,390 3,110,625 1,088,719

50% 1,310,235 655,118 1,195,617 597,808

75% 2,941,178 2,205,884 3,175,251 2,381,439

100% 10,511,929 10,511,929 8,592,299 8,592,299

150% 13,193 19,789 43,596 65,394

risk weighted assets for credit risk 26,944,278 15,081,238 23,838,388 13,089,369

risk weighted assets for market risk 22,546 35,361

risk weighted assets for operational risk 1,259,314 1,218,544

Total risk weighted assets 16,363,098 14,343,274