Page 337 - Bank-Muamalat-AR2020

P. 337

335

Our Performance Sustainability Statement Governance Our Numbers Other Information

47. FAIr vALuE MEASurEMENTS (CONT’D.)

(b) Financial instruments not carried at fair value (cont’d.)

Financing of customers

The fair values of financing of customers not designated as hedged item are estimated based on expected future cash flows

of contractual instalment payments, discounted at applicable and prevailing rates at reporting date offered for similar

facilities to new customers with similar credit profiles. In respect of non-performing financing, the fair values are deemed

to approximate the carrying values, which are net of individual assessment allowance for bad and doubtful financing.

Deposits from customers

The fair values of deposits from customers are estimated to approximate their carrying values as the profit rates are

determined at the end of their holding periods based on the actual profits generated from the assets invested.

Subordinated sukuk & Senior sukuk

The fair values of subordinated obligations are estimated by discounting the expected future cash flows using the

applicable prevailing profit rates for financing with similar risk profiles.

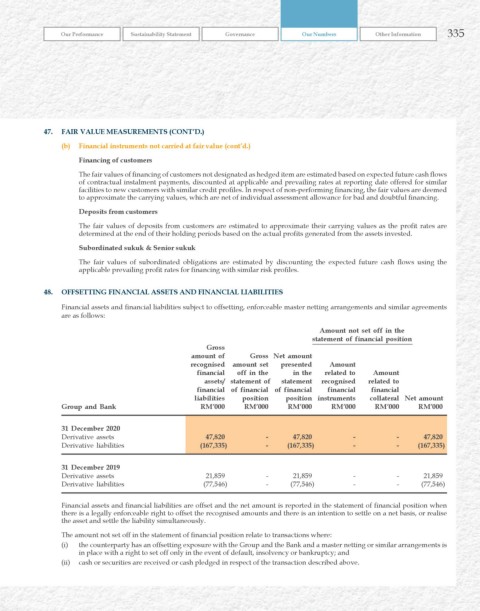

48. OFFSETTING FINANCIAL ASSETS AND FINANCIAL LIABILITIES

Financial assets and financial liabilities subject to offsetting, enforceable master netting arrangements and similar agreements

are as follows:

Amount not set off in the

statement of financial position

Gross

amount of Gross Net amount

recognised amount set presented Amount

financial off in the in the related to Amount

assets/ statement of statement recognised related to

financial of financial of financial financial financial

liabilities position position instruments collateral Net amount

Group and Bank rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

31 December 2020

Derivative assets 47,820 - 47,820 - - 47,820

Derivative liabilities (167,335) - (167,335) - - (167,335)

31 December 2019

Derivative assets 21,859 - 21,859 - - 21,859

Derivative liabilities (77,546) - (77,546) - - (77,546)

Financial assets and financial liabilities are offset and the net amount is reported in the statement of financial position when

there is a legally enforceable right to offset the recognised amounts and there is an intention to settle on a net basis, or realise

the asset and settle the liability simultaneously.

The amount not set off in the statement of financial position relate to transactions where:

(i) the counterparty has an offsetting exposure with the Group and the Bank and a master netting or similar arrangements is

in place with a right to set off only in the event of default, insolvency or bankruptcy; and

(ii) cash or securities are received or cash pledged in respect of the transaction described above.