Page 339 - Bank-Muamalat-AR2020

P. 339

337

Our Performance Sustainability Statement Governance Our Numbers Other Information

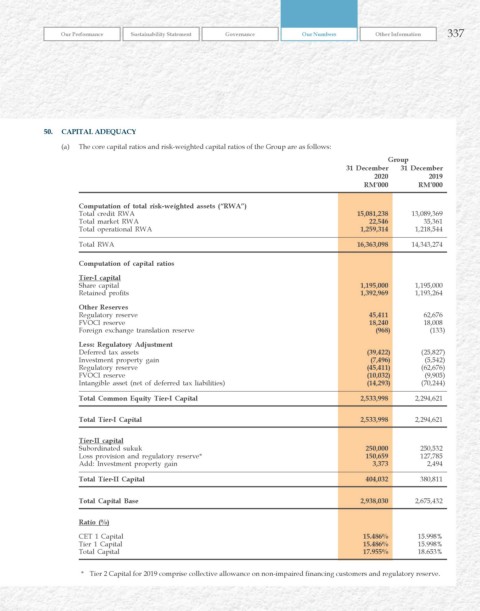

50. CAPITAL ADEquACy

(a) The core capital ratios and risk-weighted capital ratios of the Group are as follows:

Group

31 December 31 December

2020 2019

rM’000 rM’000

Computation of total risk-weighted assets (“rwA”)

Total credit RWA 15,081,238 13,089,369

Total market RWA 22,546 35,361

Total operational RWA 1,259,314 1,218,544

Total RWA 16,363,098 14,343,274

Computation of capital ratios

Tier-I capital

Share capital 1,195,000 1,195,000

Retained profits 1,392,969 1,193,264

Other reserves

Regulatory reserve 45,411 62,676

FVOCI reserve 18,240 18,008

Foreign exchange translation reserve (968) (133)

Less: regulatory Adjustment

Deferred tax assets (39,422) (25,827)

Investment property gain (7,496) (5,542)

Regulatory reserve (45,411) (62,676)

FVOCI reserve (10,032) (9,905)

Intangible asset (net of deferred tax liabilities) (14,293) (70,244)

Total Common Equity Tier-I Capital 2,533,998 2,294,621

Total Tier-I Capital 2,533,998 2,294,621

Tier-II capital

Subordinated sukuk 250,000 250,532

Loss provision and regulatory reserve* 150,659 127,785

Add: Investment property gain 3,373 2,494

Total Tier-II Capital 404,032 380,811

Total Capital Base 2,938,030 2,675,432

ratio (%)

CET 1 Capital 15.486% 15.998%

Tier 1 Capital 15.486% 15.998%

Total Capital 17.955% 18.653%

* Tier 2 Capital for 2019 comprise collective allowance on non-impaired financing customers and regulatory reserve.