Page 336 - Bank-Muamalat-AR2020

P. 336

334 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

Notes to the fiNaNcial statemeNts

31 December 2020 (16 JamaDil awal 1442h)

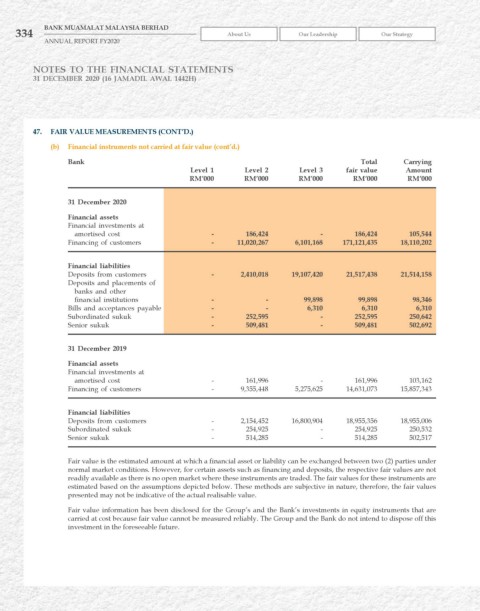

47. FAIr vALuE MEASurEMENTS (CONT’D.)

(b) Financial instruments not carried at fair value (cont’d.)

Bank Total Carrying

Level 1 Level 2 Level 3 fair value Amount

rM’000 rM’000 rM’000 rM’000 rM’000

31 December 2020

Financial assets

Financial investments at

amortised cost - 186,424 - 186,424 105,544

Financing of customers - 11,020,267 6,101,168 171,121,435 18,110,202

Financial liabilities

Deposits from customers - 2,410,018 19,107,420 21,517,438 21,514,158

Deposits and placements of

banks and other

financial institutions - - 99,898 99,898 98,346

Bills and acceptances payable - - 6,310 6,310 6,310

Subordinated sukuk - 252,595 - 252,595 250,642

Senior sukuk - 509,481 - 509,481 502,692

31 December 2019

Financial assets

Financial investments at

amortised cost - 161,996 - 161,996 103,162

Financing of customers - 9,355,448 5,275,625 14,631,073 15,857,343

Financial liabilities

Deposits from customers - 2,154,452 16,800,904 18,955,356 18,955,006

Subordinated sukuk - 254,925 - 254,925 250,532

Senior sukuk - 514,285 - 514,285 502,517

Fair value is the estimated amount at which a financial asset or liability can be exchanged between two (2) parties under

normal market conditions. However, for certain assets such as financing and deposits, the respective fair values are not

readily available as there is no open market where these instruments are traded. The fair values for these instruments are

estimated based on the assumptions depicted below. These methods are subjective in nature, therefore, the fair values

presented may not be indicative of the actual realisable value.

Fair value information has been disclosed for the Group’s and the Bank’s investments in equity instruments that are

carried at cost because fair value cannot be measured reliably. The Group and the Bank do not intend to dispose off this

investment in the foreseeable future.