Page 333 - Bank-Muamalat-AR2020

P. 333

331

Our Performance Sustainability Statement Governance Our Numbers Other Information

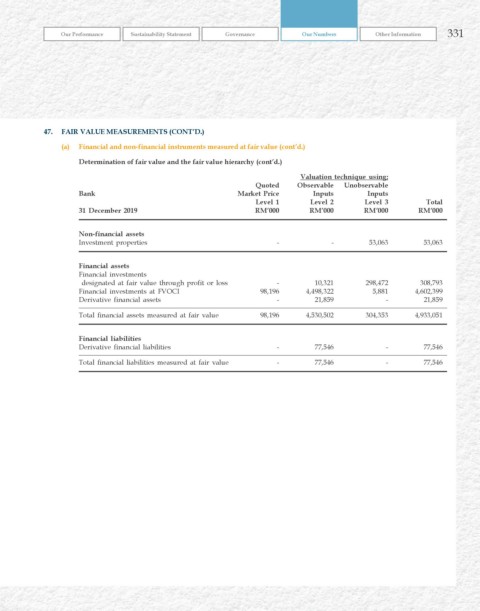

47. FAIr vALuE MEASurEMENTS (CONT’D.)

(a) Financial and non-financial instruments measured at fair value (cont’d.)

Determination of fair value and the fair value hierarchy (cont’d.)

valuation technique using;

quoted Observable unobservable

Bank Market Price Inputs Inputs

Level 1 Level 2 Level 3 Total

31 December 2019 rM’000 rM’000 rM’000 rM’000

Non-financial assets

Investment properties - - 53,063 53,063

Financial assets

Financial investments

designated at fair value through profit or loss - 10,321 298,472 308,793

Financial investments at FVOCI 98,196 4,498,322 5,881 4,602,399

Derivative financial assets - 21,859 - 21,859

Total financial assets measured at fair value 98,196 4,530,502 304,353 4,933,051

Financial liabilities

Derivative financial liabilities - 77,546 - 77,546

Total financial liabilities measured at fair value - 77,546 - 77,546