Page 330 - Bank-Muamalat-AR2020

P. 330

328 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

Notes to the fiNaNcial statemeNts

31 December 2020 (16 JamaDil awal 1442h)

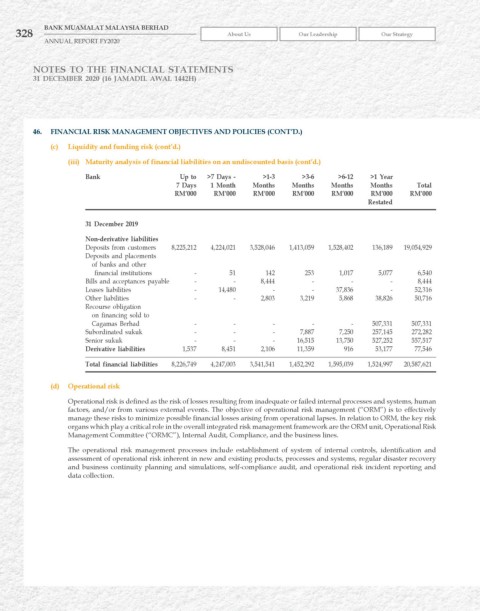

46. FINANCIAL rISk MANAGEMENT OBJECTIvES AND POLICIES (CONT’D.)

(c) Liquidity and funding risk (cont’d.)

(iii) Maturity analysis of financial liabilities on an undiscounted basis (cont’d.)

Bank up to >7 Days - >1-3 >3-6 >6-12 >1 year

7 Days 1 Month Months Months Months Months Total

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

restated

31 December 2019

Non-derivative liabilities

Deposits from customers 8,225,212 4,224,021 3,528,046 1,413,059 1,528,402 136,189 19,054,929

Deposits and placements

of banks and other

financial institutions - 51 142 253 1,017 5,077 6,540

Bills and acceptances payable - - 8,444 - - - 8,444

Leases liabilities - 14,480 - - 37,836 - 52,316

Other liabilities - - 2,803 3,219 5,868 38,826 50,716

Recourse obligation

on financing sold to

Cagamas Berhad - - - - - 507,331 507,331

Subordinated sukuk - - - 7,887 7,250 257,145 272,282

Senior sukuk - - - 16,515 13,750 527,252 557,517

Derivative liabilities 1,537 8,451 2,106 11,359 916 53,177 77,546

Total financial liabilities 8,226,749 4,247,003 3,541,541 1,452,292 1,595,039 1,524,997 20,587,621

(d) Operational risk

Operational risk is defined as the risk of losses resulting from inadequate or failed internal processes and systems, human

factors, and/or from various external events. The objective of operational risk management (“ORM”) is to effectively

manage these risks to minimize possible financial losses arising from operational lapses. In relation to ORM, the key risk

organs which play a critical role in the overall integrated risk management framework are the ORM unit, Operational Risk

Management Committee (“ORMC”), Internal Audit, Compliance, and the business lines.

The operational risk management processes include establishment of system of internal controls, identification and

assessment of operational risk inherent in new and existing products, processes and systems, regular disaster recovery

and business continuity planning and simulations, self-compliance audit, and operational risk incident reporting and

data collection.