Page 327 - Bank-Muamalat-AR2020

P. 327

325

Our Performance Sustainability Statement Governance Our Numbers Other Information

46. FINANCIAL rISk MANAGEMENT OBJECTIvES AND POLICIES (CONT’D.)

(c) Liquidity and funding risk (cont’d.)

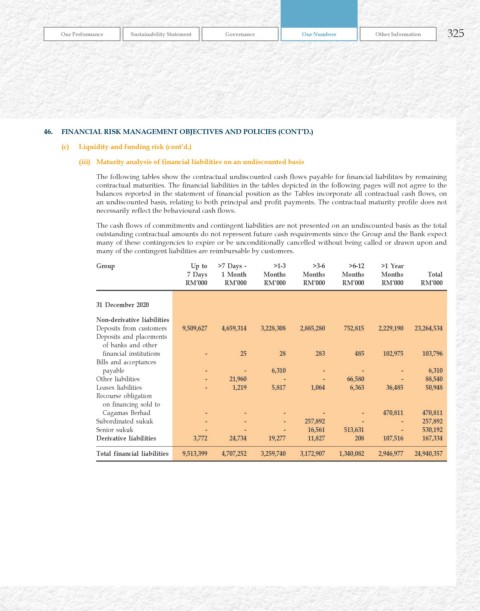

(iii) Maturity analysis of financial liabilities on an undiscounted basis

The following tables show the contractual undiscounted cash flows payable for financial liabilities by remaining

contractual maturities. The financial liabilities in the tables depicted in the following pages will not agree to the

balances reported in the statement of financial position as the Tables incorporate all contractual cash flows, on

an undiscounted basis, relating to both principal and profit payments. The contractual maturity profile does not

necessarily reflect the behavioural cash flows.

The cash flows of commitments and contingent liabilities are not presented on an undiscounted basis as the total

outstanding contractual amounts do not represent future cash requirements since the Group and the Bank expect

many of these contingencies to expire or be unconditionally cancelled without being called or drawn upon and

many of the contingent liabilities are reimbursable by customers.

Group up to >7 Days - >1-3 >3-6 >6-12 >1 year

7 Days 1 Month Months Months Months Months Total

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

31 December 2020

Non-derivative liabilities

Deposits from customers 9,509,627 4,659,314 3,228,308 2,885,280 752,815 2,229,190 23,264,534

Deposits and placements

of banks and other

financial institutions - 25 28 283 485 102,975 103,796

Bills and acceptances

payable - - 6,310 - - - 6,310

Other liabilities - 21,960 - - 66,580 - 88,540

Leases liabilities - 1,219 5,817 1,064 6,363 36,485 50,948

Recourse obligation

on financing sold to

Cagamas Berhad - - - - - 470,811 470,811

Subordinated sukuk - - - 257,892 - - 257,892

Senior sukuk - - - 16,561 513,631 - 530,192

Derivative liabilities 3,772 24,734 19,277 11,827 208 107,516 167,334

Total financial liabilities 9,513,399 4,707,252 3,259,740 3,172,907 1,340,082 2,946,977 24,940,357