Page 326 - Bank-Muamalat-AR2020

P. 326

324 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

Notes to the fiNaNcial statemeNts

31 December 2020 (16 JamaDil awal 1442h)

46. FINANCIAL rISk MANAGEMENT OBJECTIvES AND POLICIES (CONT’D.)

(c) Liquidity and funding risk (cont’d.)

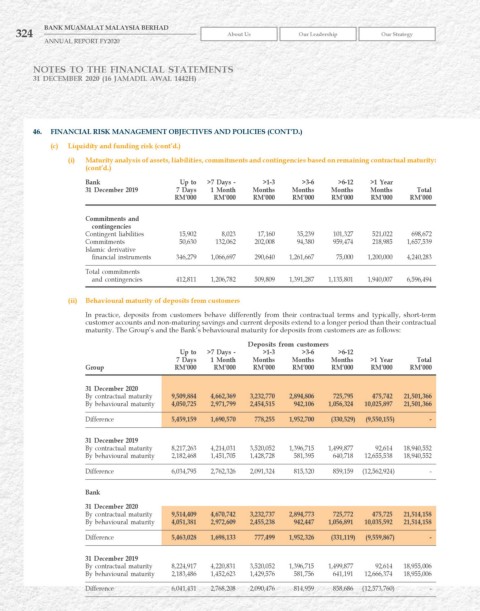

(i) Maturity analysis of assets, liabilities, commitments and contingencies based on remaining contractual maturity:

(cont’d.)

Bank up to >7 Days - >1-3 >3-6 >6-12 >1 year

31 December 2019 7 Days 1 Month Months Months Months Months Total

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

Commitments and

contingencies

Contingent liabilities 15,902 8,023 17,160 35,239 101,327 521,022 698,672

Commitments 50,630 132,062 202,008 94,380 959,474 218,985 1,657,539

Islamic derivative

financial instruments 346,279 1,066,697 290,640 1,261,667 75,000 1,200,000 4,240,283

Total commitments

and contingencies 412,811 1,206,782 509,809 1,391,287 1,135,801 1,940,007 6,596,494

(ii) Behavioural maturity of deposits from customers

In practice, deposits from customers behave differently from their contractual terms and typically, short-term

customer accounts and non-maturing savings and current deposits extend to a longer period than their contractual

maturity. The Group’s and the Bank’s behavioural maturity for deposits from customers are as follows:

Deposits from customers

up to >7 Days - >1-3 >3-6 >6-12

7 Days 1 Month Months Months Months >1 year Total

Group rM’000 rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

31 December 2020

By contractual maturity 9,509,884 4,662,369 3,232,770 2,894,806 725,795 475,742 21,501,366

By behavioural maturity 4,050,725 2,971,799 2,454,515 942,106 1,056,324 10,025,897 21,501,366

Difference 5,459,159 1,690,570 778,255 1,952,700 (330,529) (9,550,155) -

31 December 2019

By contractual maturity 8,217,263 4,214,031 3,520,052 1,396,715 1,499,877 92,614 18,940,552

By behavioural maturity 2,182,468 1,451,705 1,428,728 581,395 640,718 12,655,538 18,940,552

Difference 6,034,795 2,762,326 2,091,324 815,320 859,159 (12,562,924) -

Bank

31 December 2020

By contractual maturity 9,514,409 4,670,742 3,232,737 2,894,773 725,772 475,725 21,514,158

By behavioural maturity 4,051,381 2,972,609 2,455,238 942,447 1,056,891 10,035,592 21,514,158

Difference 5,463,028 1,698,133 777,499 1,952,326 (331,119) (9,559,867) -

31 December 2019

By contractual maturity 8,224,917 4,220,831 3,520,052 1,396,715 1,499,877 92,614 18,955,006

By behavioural maturity 2,183,486 1,452,623 1,429,576 581,756 641,191 12,666,374 18,955,006

Difference 6,041,431 2,768,208 2,090,476 814,959 858,686 (12,573,760) -