Page 332 - Bank-Muamalat-AR2020

P. 332

330 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

Notes to the fiNaNcial statemeNts

31 December 2020 (16 JamaDil awal 1442h)

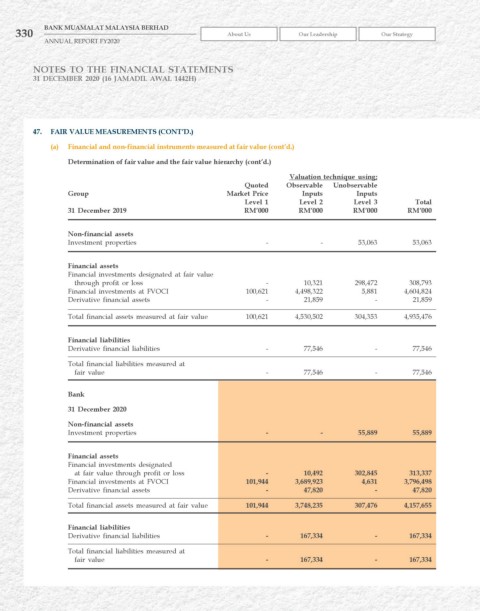

47. FAIr vALuE MEASurEMENTS (CONT’D.)

(a) Financial and non-financial instruments measured at fair value (cont’d.)

Determination of fair value and the fair value hierarchy (cont’d.)

valuation technique using;

quoted Observable unobservable

Group Market Price Inputs Inputs

Level 1 Level 2 Level 3 Total

31 December 2019 rM’000 rM’000 rM’000 rM’000

Non-financial assets

Investment properties - - 53,063 53,063

Financial assets

Financial investments designated at fair value

through profit or loss - 10,321 298,472 308,793

Financial investments at FVOCI 100,621 4,498,322 5,881 4,604,824

Derivative financial assets - 21,859 - 21,859

Total financial assets measured at fair value 100,621 4,530,502 304,353 4,935,476

Financial liabilities

Derivative financial liabilities - 77,546 - 77,546

Total financial liabilities measured at

fair value - 77,546 - 77,546

Bank

31 December 2020

Non-financial assets

Investment properties - - 55,889 55,889

Financial assets

Financial investments designated

at fair value through profit or loss - 10,492 302,845 313,337

Financial investments at FVOCI 101,944 3,689,923 4,631 3,796,498

Derivative financial assets - 47,820 - 47,820

Total financial assets measured at fair value 101,944 3,748,235 307,476 4,157,655

Financial liabilities

Derivative financial liabilities - 167,334 - 167,334

Total financial liabilities measured at

fair value - 167,334 - 167,334