Page 347 - Bank-Muamalat-AR2020

P. 347

345

Our Performance Sustainability Statement Governance Our Numbers Other Information

52. ShArIAh DISCLOSurES

(a) Shariah governance

Overview

The Group’s and the Bank’s shariah governance structure are governed by BNM’s guidelines on Shariah Governance

Policy Document which comes into effect on 1 April 2020 and any related guidelines issued by the authorities, subject to

variations and amendments from time to time.

In this context, Shariah non-compliance risk defined as the risk that arises from the Group’s and the Bank’s failure to

comply with the Shariah rules and principles determined by the Shariah Committee (“SC”) of the Group and the Bank

and relevant Shariah Authorities (“SA”) committees.

This risk is managed through the Shariah Governance Policy, which is endorsed by the SC and approved by the Board of

Directors. The policy is drawn up in accordance to the Shariah Governance Policy Document.

To ensure the operations and business activities of the Group and the Bank remain consistent with Shariah principles and

its requirements, the Bank has established its own internal SC and internal Shariah organisation, which consists of the

Shariah Division, Shariah Audit under the Internal Audit Department, Shariah Review under the Compliance Division

and Shariah Risk under the Risk Management Department.

rectification Process of Shariah Non-Compliance Income (“SNCI”) and unidentified Funds

Policy on Management of Shariah Non-Compliance Income was formulated pursuant to the Shariah Governance Policy

Document, which defines the principles and practices to be applied by the Bank in managing its SNCI.

SNCI is an income generated from any transactions that breaches the governing Shariah principles and requirements as

determined by the Group’s and the Bank’s SC and/or other Shariah Authorities (“SA”).

The SA are as follows:

- Shariah Advisory Council of Bank Negara Malaysia.

- Shariah Advisory Council of Securities Commission Malaysia.

- Any other relevent Shariah resolutions and rulings as prescribed and determined by the SC of the Bank from time

to time.

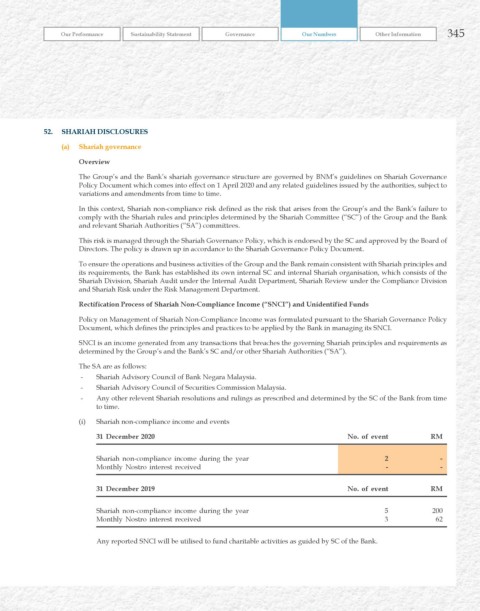

(i) Shariah non-compliance income and events

31 December 2020 No. of event rM

Shariah non-compliance income during the year 2 -

Monthly Nostro interest received - -

31 December 2019 No. of event rM

Shariah non-compliance income during the year 5 200

Monthly Nostro interest received 3 62

Any reported SNCI will be utilised to fund charitable activities as guided by SC of the Bank.