Page 348 - Bank-Muamalat-AR2020

P. 348

346 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

Notes to the fiNaNcial statemeNts

31 December 2020 (16 JamaDil awal 1442h)

52. ShArIAh DISCLOSurES (CONT’D.)

(a) Shariah governance (cont’d.)

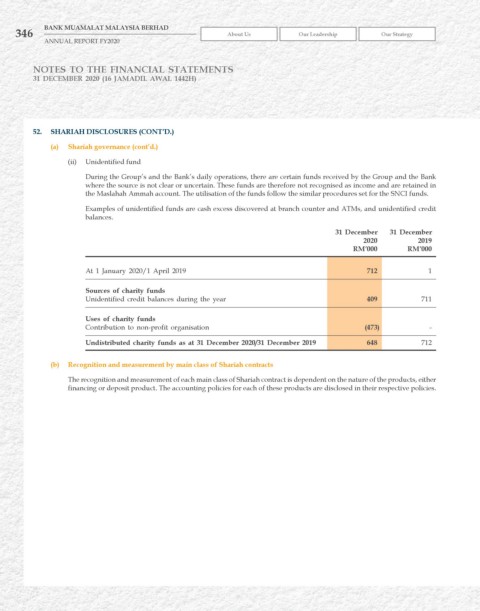

(ii) Unidentified fund

During the Group’s and the Bank’s daily operations, there are certain funds received by the Group and the Bank

where the source is not clear or uncertain. These funds are therefore not recognised as income and are retained in

the Maslahah Ammah account. The utilisation of the funds follow the similar procedures set for the SNCI funds.

Examples of unidentified funds are cash excess discovered at branch counter and ATMs, and unidentified credit

balances.

31 December 31 December

2020 2019

rM’000 rM’000

At 1 January 2020/1 April 2019 712 1

Sources of charity funds

Unidentified credit balances during the year 409 711

uses of charity funds

Contribution to non-profit organisation (473) -

undistributed charity funds as at 31 December 2020/31 December 2019 648 712

(b) recognition and measurement by main class of Shariah contracts

The recognition and measurement of each main class of Shariah contract is dependent on the nature of the products, either

financing or deposit product. The accounting policies for each of these products are disclosed in their respective policies.