Page 231 - Bank-Muamalat-AR2020

P. 231

229

Our Performance Sustainability Statement Governance Our Numbers Other Information

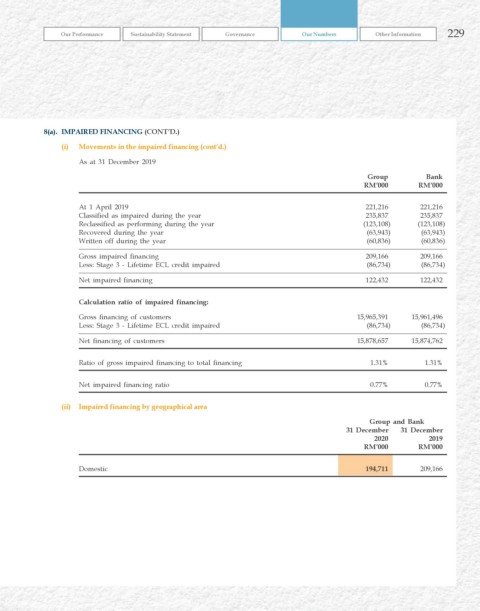

8(a). IMPAIrED FINANCING (CONT’D.)

(i) Movements in the impaired financing (cont’d.)

As at 31 December 2019

Group Bank

rM’000 rM’000

At 1 April 2019 221,216 221,216

Classified as impaired during the year 235,837 235,837

Reclassified as performing during the year (123,108) (123,108)

Recovered during the year (63,943) (63,943)

Written off during the year (60,836) (60,836)

Gross impaired financing 209,166 209,166

Less: Stage 3 - Lifetime ECL credit impaired (86,734) (86,734)

Net impaired financing 122,432 122,432

Calculation ratio of impaired financing:

Gross financing of customers 15,965,391 15,961,496

Less: Stage 3 - Lifetime ECL credit impaired (86,734) (86,734)

Net financing of customers 15,878,657 15,874,762

Ratio of gross impaired financing to total financing 1.31% 1.31%

Net impaired financing ratio 0.77% 0.77%

(ii) Impaired financing by geographical area

Group and Bank

31 December 31 December

2020 2019

rM’000 rM’000

Domestic 194,711 209,166