Page 229 - Bank-Muamalat-AR2020

P. 229

227

Our Performance Sustainability Statement Governance Our Numbers Other Information

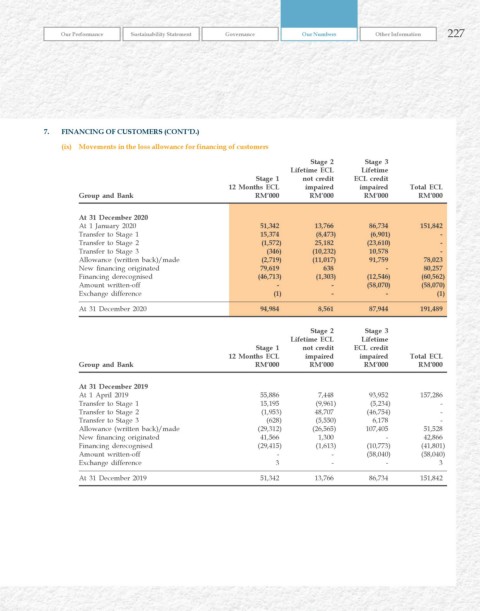

7. FINANCING OF CuSTOMErS (CONT’D.)

(ix) Movements in the loss allowance for financing of customers

Stage 2 Stage 3

Lifetime ECL Lifetime

Stage 1 not credit ECL credit

12 Months ECL impaired impaired Total ECL

Group and Bank rM’000 rM’000 rM’000 rM’000

At 31 December 2020

At 1 January 2020 51,342 13,766 86,734 151,842

Transfer to Stage 1 15,374 (8,473) (6,901) -

Transfer to Stage 2 (1,572) 25,182 (23,610) -

Transfer to Stage 3 (346) (10,232) 10,578 -

Allowance (written back)/made (2,719) (11,017) 91,759 78,023

New financing originated 79,619 638 - 80,257

Financing derecognised (46,713) (1,303) (12,546) (60,562)

Amount written-off - - (58,070) (58,070)

Exchange difference (1) - - (1)

At 31 December 2020 94,984 8,561 87,944 191,489

Stage 2 Stage 3

Lifetime ECL Lifetime

Stage 1 not credit ECL credit

12 Months ECL impaired impaired Total ECL

Group and Bank rM’000 rM’000 rM’000 rM’000

At 31 December 2019

At 1 April 2019 55,886 7,448 93,952 157,286

Transfer to Stage 1 15,195 (9,961) (5,234) -

Transfer to Stage 2 (1,953) 48,707 (46,754) -

Transfer to Stage 3 (628) (5,550) 6,178 -

Allowance (written back)/made (29,312) (26,565) 107,405 51,528

New financing originated 41,566 1,300 - 42,866

Financing derecognised (29,415) (1,613) (10,773) (41,801)

Amount written-off - - (58,040) (58,040)

Exchange difference 3 - - 3

At 31 December 2019 51,342 13,766 86,734 151,842