Page 235 - Bank-Muamalat-AR2020

P. 235

233

Our Performance Sustainability Statement Governance Our Numbers Other Information

8(b). ExPOSurES TO COvID-19 IMPACTED FINANCING (CONT’D.)

Total rM’000 31,230 - 17,003 - 14,147 - 79 - 79 - - - 54.44% - 45.30% - 0.25% - 100.00% - Total rM’000 1,475,122 - 1,474,577 - 544 - 544 - - - 99.96% - - - 0.04% - 100.00% - (iii) Overlays and adjustments for expected credit losses amid COvID-19 environment

Non-retail customers as at 31 December 2020 Corporates Stage 2 Stage 1 Stage 2 rM’000 rM’000 rM’000 - 424 - - - 344 - 79 - 79 - - - 0.00% - 81.28% - 18.72% - 100.00% Non-retail customers as at 31 December 2020 Corporates Stage 2 Stage 1 Stage 2 rM’000 rM’000 rM’000 1,458,269 344 1,457,724 344 544 - 544 - - - 99.96% 100.00% - - 0.04% - 100.00% 100

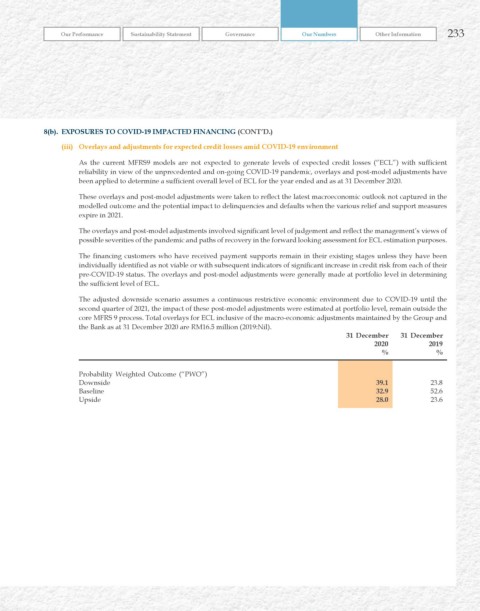

As the current MFRS9 models are not expected to generate levels of expected credit losses (“ECL”) with sufficient

reliability in view of the unprecedented and on-going COVID-19 pandemic, overlays and post-model adjustments have

These overlays and post-model adjustments were taken to reflect the latest macroeconomic outlook not captured in the

modelled outcome and the potential impact to delinquencies and defaults when the various relief and support measures

expire in 2021.

The overlays and post-model adjustments involved significant level of judgement and reflect the management’s views of

possible severities of the pandemic and paths of recovery in the forward looking assessment for ECL estimation purposes.

individually identified as not viable or with subsequent indicators of significant increase in credit risk from each of their

Financing of customers: SMEs Total Stage 1 rM’000 rM’000 30,806 8,379,496 17,003 7,551,227 13,803 645,683 - 182,585 - 5,488 - 27,784 55.19% 90.12% 44.81% 7.71% - 2.18% 100.00% 100.00% Financing of customers: SMEs Total Stage 1 rM’000 rM’000 16,509 679,186 16,509 660,437 - 18,749 - 18,627 - 123 - 100.00% 97.24% - - - - 2.76% 100.00% 10

pre-COVID-19 status. The overlays and post-model adjustments were generally made at portfolio level in determining

the sufficient level of ECL.

The adjusted downside scenario assumes a continuous restrictive economic environment due to COVID-19 until the

second quarter of 2021, the impact of these post-model adjustments were estimated at portfolio level, remain outside the

core MFRS 9 process. Total overlays for ECL inclusive of the macro-economic adjustments maintained by the Group and

retail customers as at 31 December 2020 Personal Others financing rM’000 rM’000 483,518 3,189,477 398,993 3,099,497 70,433 47,848 14,091 42,131 13,821 28,483 270 13,648 82.52% 97.18% 14.57% 1.50% 2.91% 1.32% 100.00% 100.00% PAyMENT ASSISTANCE (Targeted Payment Assistance/Enhanced Targeted Payment Assistance) retail customers as at 31 December 2020 Personal Others financing rM’000 rM’000 73,316

the Bank as at 31 December 2020 are RM16.5 million (2019:Nil).

2019

2020

Disclosure for COvID-19 customer relief and support measures

%

%

ExPOSurES TO COvID-19 IMPACTED FINANCING (CONT’D.)

39.1

23.8

Downside

52.6

32.9

Baseline

AuTOMATIC SIx-MONTh MOrATOrIuM

28.0

Upside

23.6

home financing rM’000 4,242,336 3,621,739 502,131 118,466 106,078 12,388 85.37% 11.84% 2.79% 100.00% home financing rM’000 526,634 511,057 15,576 15,454 97.04% 2.96% 100.00%

hire purchase receivables rM’000 464,165 430,998 25,271 7,897 6,418 1,478 92.85% 5.44% 1.70% 100.00% hire purchase receivables rM’000 26,621 26,599 123 99.92% - 0.08% 100.00%

Total payment moratoriums Resumed payments Extended and paying as per revised schedules Missed payments As a percentage of total: Resumed payments Extended and paying as per revised schedules Missed payments Total payment moratoriums Resumed payments Missed payments As a percentage of total: Resumed payments Extended and repaying as per revised schedules Missed payments

Delinquent Impaired Delinquent Impaired

(ii)

8(b).