Page 238 - Bank-Muamalat-AR2020

P. 238

236 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

Notes to the fiNaNcial statemeNts

31 December 2020 (16 JamaDil awal 1442h)

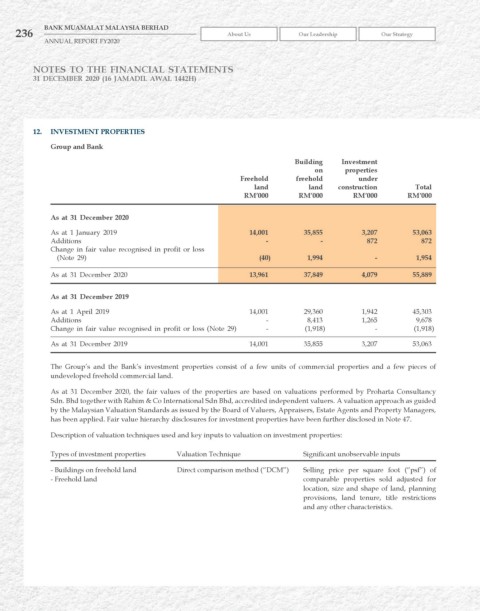

12. INvESTMENT PrOPErTIES

Group and Bank

Building Investment

on properties

Freehold freehold under

land land construction Total

rM’000 rM’000 rM’000 rM’000

As at 31 December 2020

As at 1 January 2019 14,001 35,855 3,207 53,063

Additions - - 872 872

Change in fair value recognised in profit or loss

(Note 29) (40) 1,994 - 1,954

As at 31 December 2020 13,961 37,849 4,079 55,889

As at 31 December 2019

As at 1 April 2019 14,001 29,360 1,942 45,303

Additions - 8,413 1,265 9,678

Change in fair value recognised in profit or loss (Note 29) - (1,918) - (1,918)

As at 31 December 2019 14,001 35,855 3,207 53,063

The Group’s and the Bank’s investment properties consist of a few units of commercial properties and a few pieces of

undeveloped freehold commercial land.

As at 31 December 2020, the fair values of the properties are based on valuations performed by Proharta Consultancy

Sdn. Bhd together with Rahim & Co International Sdn Bhd, accredited independent valuers. A valuation approach as guided

by the Malaysian Valuation Standards as issued by the Board of Valuers, Appraisers, Estate Agents and Property Managers,

has been applied. Fair value hierarchy disclosures for investment properties have been further disclosed in Note 47.

Description of valuation techniques used and key inputs to valuation on investment properties:

Types of investment properties Valuation Technique Significant unobservable inputs

- Buildings on freehold land Direct comparison method (“DCM”) Selling price per square foot (“psf”) of

- Freehold land comparable properties sold adjusted for

location, size and shape of land, planning

provisions, land tenure, title restrictions

and any other characteristics.