Page 86 - Bank-Muamalat_Annual-Report-2023

P. 86

BANK MUAMALAT MALAYSIA BERHAD

STAKEHOLDER

ENGAGEMENT

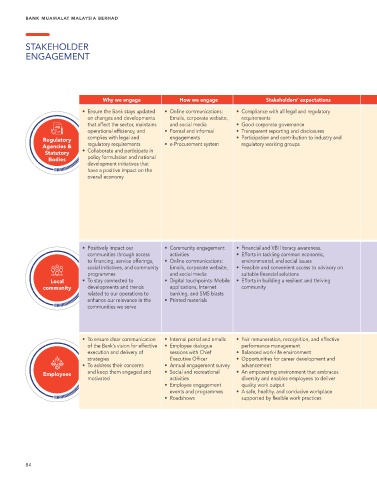

Why we engage How we engage Stakeholders’ expectations Our responses Related material matters Related UN SDGs

• Ensure the Bank stays updated • Online communications: • Compliance with all legal and regulatory • Continuously update our systems and

M1 Ethics & Integrity

on changes and developments Emails, corporate website, requirements processes to meet current compliance and

that affect the sector, maintains and social media • Good corporate governance risk requirements M2 Economic Performance

operational efficiency, and • Formal and informal • Transparent reporting and disclosures • Ensure compliance delivery, risk management, Energy consumption and

complies with legal and engagements • Participation and contribution to industry and and governance that meet regulatory M6

Regulatory environmental impact

Agencies & regulatory requirements • e-Procurement system regulatory working groups requirements M13 Responsible financing

Statutory • Collaborate and participate in • Integrate VBI elements into risk management

Bodies policy formulation and national practices

development initiatives that • Ensure timely and transparent reporting to

have a positive impact on the regulatory agencies and statutory bodies

overall economy • Actively participate in VBI working groups to

develop a sectoral guide

• Active participation in:

- CCPT working groups to adopt Due

Diligence Questions;

- CCPT Subgroup for Small Medium

Enterprises (SMEs), leading the

development of sectoral guides tailored

for high-emitting carbon sectors within the

SME sector

• Positively impact our • Community engagement • Financial and VBI literacy awareness. • Collaborate with various state religious Energy consumption and

M6

communities through access activities • Efforts in tackling common economic, councils and government agencies to address environmental impact

to financing, service offerings, • Online communications: environmental, and social issues the needs of the local communities M7 Community Development

social initiatives, and community Emails, corporate website, • Feasible and convenient access to advisory on • Provide access to advisory on suitable

programmes and social media suitable financial solutions financial solutions through digital channels

Local • To stay connected to • Digital touchpoints: Mobile • Efforts in building a resilient and thriving • Extend financial relief assistance

community developments and trends applications, Internet community • Continuously implement corporate social

related to our operations to banking, and SMS blasts responsibility initiatives

enhance our relevance in the • Printed materials

communities we serve

• To ensure clear communication • Internal portal and emails • Fair remuneration, recognition, and effective • Enhance task delegation and improve M1 Ethics & Integrity

of the Bank’s vision for effective • Employee dialogue performance management employee performance management

execution and delivery of sessions with Chief • Balanced work-life environment • Provide employee remuneration M9 Diversity and equal opportunity

strategies Executive Officer • Opportunities for career development and • Strengthen employee learning and career

• To address their concerns • Annual engagement survey advancement development programmes to equip them with M10 Training and education

and keep them engaged and • Social and recreational • An empowering environment that embraces essential skills for them to be competitive with

Employees M11 Employment

motivated activities diversity and enables employees to deliver other peers in the industry

• Employee engagement quality work output • Conduct employee engagement and

events and programmes • A safe, healthy, and conducive workplace employee satisfaction surveys

• Roadshows supported by flexible work practices • Develop a career development plan

framework and apprenticeship programme

84