Page 421 - Bank-Muamalat_Annual-Report-2023

P. 421

ANNUAL REPORT 2023

OUR NUMBERS

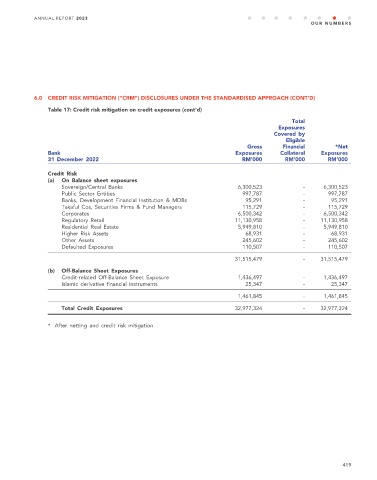

6.0 CREDIT RISK MITIGATION (“CRM”) DISCLOSURES UNDER THE STANDARDISED APPROACH (CONT’D)

Table 17: Credit risk mitigation on credit exposures (cont’d)

Total

Exposures

Covered by

Eligible

Gross Financial *Net

Bank Exposures Collateral Exposures

31 December 2022 RM’000 RM’000 RM’000

Credit Risk

(a) On Balance sheet exposures

Sovereign/Central Banks 6,300,523 - 6,300,523

Public Sector Entities 997,787 - 997,787

Banks, Development Financial Institution & MDBs 95,291 - 95,291

Takaful Cos, Securities Firms & Fund Managers 115,729 - 115,729

Corporates 6,500,342 - 6,500,342

Regulatory Retail 11,130,958 - 11,130,958

Residential Real Estate 5,949,810 - 5,949,810

Higher Risk Assets 68,931 - 68,931

Other Assets 245,602 - 245,602

Defaulted Exposures 110,507 - 110,507

31,515,479 - 31,515,479

(b) Off-Balance Sheet Exposures

Credit-related Off-Balance Sheet Exposure 1,436,497 - 1,436,497

Islamic derivative financial instruments 25,347 - 25,347

1,461,845 - 1,461,845

Total Credit Exposures 32,977,324 - 32,977,324

* After netting and credit risk mitigation

419