Page 419 - Bank-Muamalat_Annual-Report-2023

P. 419

ANNUAL REPORT 2023

OUR NUMBERS

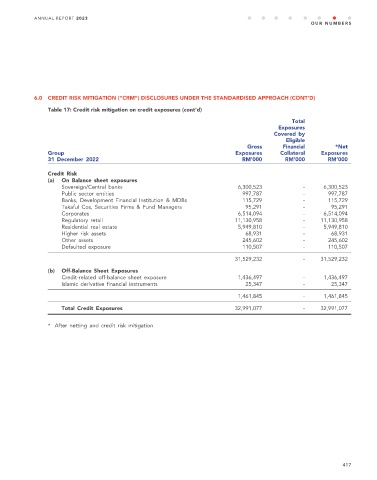

6.0 CREDIT RISK MITIGATION (“CRM”) DISCLOSURES UNDER THE STANDARDISED APPROACH (CONT’D)

Table 17: Credit risk mitigation on credit exposures (cont’d)

Total

Exposures

Covered by

Eligible

Gross Financial *Net

Group Exposures Collateral Exposures

31 December 2022 RM’000 RM’000 RM’000

Credit Risk

(a) On Balance sheet exposures

Sovereign/Central banks 6,300,523 - 6,300,523

Public sector entities 997,787 - 997,787

Banks, Development Financial Institution & MDBs 115,729 - 115,729

Takaful Cos, Securities Firms & Fund Managers 95,291 - 95,291

Corporates 6,514,094 - 6,514,094

Regulatory retail 11,130,958 - 11,130,958

Residential real estate 5,949,810 - 5,949,810

Higher risk assets 68,931 - 68,931

Other assets 245,602 - 245,602

Defaulted exposure 110,507 - 110,507

31,529,232 - 31,529,232

(b) Off-Balance Sheet Exposures

Credit-related off-balance sheet exposure 1,436,497 - 1,436,497

Islamic derivative financial instruments 25,347 - 25,347

1,461,845 - 1,461,845

Total Credit Exposures 32,991,077 - 32,991,077

* After netting and credit risk mitigation

417