Page 423 - Bank-Muamalat_Annual-Report-2023

P. 423

ANNUAL REPORT 2023

OUR NUMBERS

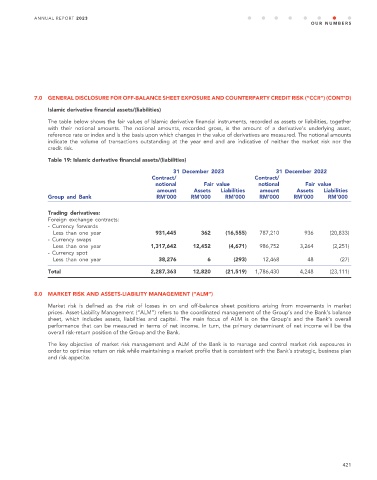

7.0 GENERAL DISCLOSURE FOR OFF-BALANCE SHEET EXPOSURE AND COUNTERPARTY CREDIT RISK (“CCR”) (CONT’D)

Islamic derivative financial assets/(liabilities)

The table below shows the fair values of Islamic derivative financial instruments, recorded as assets or liabilities, together

with their notional amounts. The notional amounts, recorded gross, is the amount of a derivative’s underlying asset,

reference rate or index and is the basis upon which changes in the value of derivatives are measured. The notional amounts

indicate the volume of transactions outstanding at the year end and are indicative of neither the market risk nor the

credit risk.

Table 19: Islamic derivative financial assets/(liabilities)

31 December 2023 31 December 2022

Contract/ Contract/

notional Fair value notional Fair value

amount Assets Liabilities amount Assets Liabilities

Group and Bank RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

Trading derivatives:

Foreign exchange contracts:

- Currency forwards

Less than one year 931,445 362 (16,555) 787,210 936 (20,833)

- Currency swaps

Less than one year 1,317,642 12,452 (4,671) 986,752 3,264 (2,251)

- Currency spot

Less than one year 38,276 6 (293) 12,468 48 (27)

Total 2,287,363 12,820 (21,519) 1,786,430 4,248 (23,111)

8.0 MARKET RISK AND ASSETS-LIABILITY MANAGEMENT (“ALM”)

Market risk is defined as the risk of losses in on and off-balance sheet positions arising from movements in market

prices. Asset-Liability Management (“ALM”) refers to the coordinated management of the Group’s and the Bank’s balance

sheet, which includes assets, liabilities and capital. The main focus of ALM is on the Group’s and the Bank’s overall

performance that can be measured in terms of net income. In turn, the primary determinant of net income will be the

overall risk-return position of the Group and the Bank.

The key objective of market risk management and ALM of the Bank is to manage and control market risk exposures in

order to optimise return on risk while maintaining a market profile that is consistent with the Bank’s strategic, business plan

and risk appetite.

421