Page 312 - Bank-Muamalat_Annual-Report-2023

P. 312

BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2023 (18 JAMADIL AKHIR 1445H)

47. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

(a) Credit risk (cont’d.)

(ii) Credit quality for financing of customers (cont’d.)

Neither past due nor impaired

Financing of customers which are neither past due nor impaired are identified into the following grades:

- “Good grade” refers to financing of customers which are neither past due nor impaired in the last six (6)

months and have never undergone any rescheduling or restructuring exercise previously.

- “Satisfactory grade” refers to financing of customers which may have been past due but not impaired

or impaired during the last six (6) months or have undergone a rescheduling or restructuring exercise

previously.

Past due but not impaired

Past due but not impaired financing of customers refers to instances where the customer has failed to make

principal or profit payment or both after the contractual due date for more than one (1) day but less than

three (3) months.

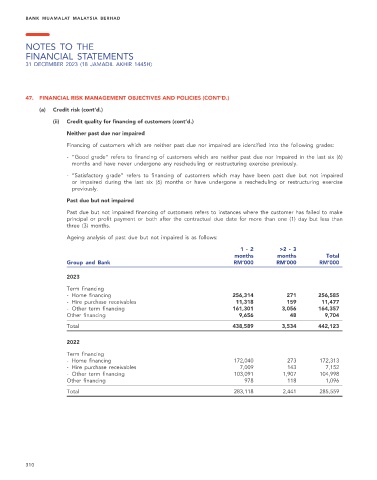

Ageing analysis of past due but not impaired is as follows:

1 - 2 >2 - 3

months months Total

Group and Bank RM’000 RM’000 RM’000

2023

Term financing

- Home financing 256,314 271 256,585

- Hire purchase receivables 11,318 159 11,477

- Other term financing 161,301 3,056 164,357

Other financing 9,656 48 9,704

Total 438,589 3,534 442,123

2022

Term financing

- Home financing 172,040 273 172,313

- Hire purchase receivables 7,009 143 7,152

- Other term financing 103,091 1,907 104,998

Other financing 978 118 1,096

Total 283,118 2,441 285,559

310