Page 309 - Bank-Muamalat_Annual-Report-2023

P. 309

ANNUAL REPORT 2023

OUR NUMBERS

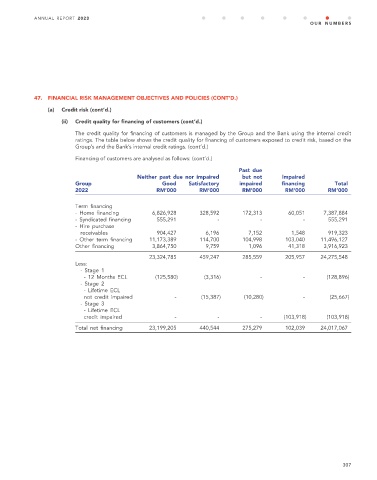

47. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

(a) Credit risk (cont’d.)

(ii) Credit quality for financing of customers (cont’d.)

The credit quality for financing of customers is managed by the Group and the Bank using the internal credit

ratings. The table below shows the credit quality for financing of customers exposed to credit risk, based on the

Group’s and the Bank’s internal credit ratings. (cont’d.)

Financing of customers are analysed as follows: (cont’d.)

Past due

Neither past due nor impaired but not Impaired

Group Good Satisfactory impaired financing Total

2022 RM’000 RM’000 RM’000 RM’000 RM’000

Term financing

- Home financing 6,826,928 328,592 172,313 60,051 7,387,884

- Syndicated financing 555,291 - - - 555,291

- Hire purchase

receivables 904,427 6,196 7,152 1,548 919,323

- Other term financing 11,173,389 114,700 104,998 103,040 11,496,127

Other financing 3,864,750 9,759 1,096 41,318 3,916,923

23,324,785 459,247 285,559 205,957 24,275,548

Less:

- Stage 1

- 12 Months ECL (125,580) (3,316) - - (128,896)

- Stage 2

- Lifetime ECL

not credit impaired - (15,387) (10,280) - (25,667)

- Stage 3

- Lifetime ECL

credit impaired - - - (103,918) (103,918)

Total net financing 23,199,205 440,544 275,279 102,039 24,017,067

307