Page 307 - Bank-Muamalat_Annual-Report-2023

P. 307

ANNUAL REPORT 2023

OUR NUMBERS

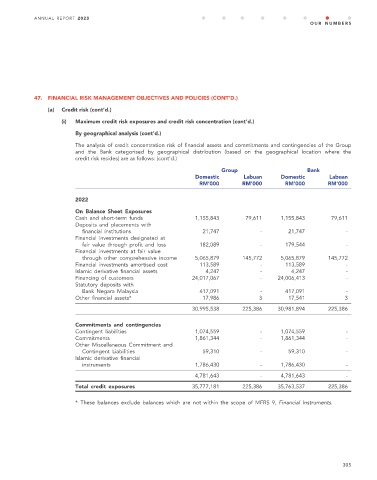

47. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

(a) Credit risk (cont’d.)

(i) Maximum credit risk exposures and credit risk concentration (cont’d.)

By geographical analysis (cont’d.)

The analysis of credit concentration risk of financial assets and commitments and contingencies of the Group

and the Bank categorised by geographical distribution (based on the geographical location where the

credit risk resides) are as follows: (cont’d.)

Group Bank

Domestic Labuan Domestic Labuan

RM’000 RM’000 RM’000 RM’000

2022

On Balance Sheet Exposures

Cash and short-term funds 1,155,843 79,611 1,155,843 79,611

Deposits and placements with

financial institutions 21,747 - 21,747 -

Financial investments designated at

fair value through profit and loss 182,089 - 179,544 -

Financial investments at fair value

through other comprehensive income 5,065,879 145,772 5,065,879 145,772

Financial investments amortised cost 113,589 - 113,589 -

Islamic derivative financial assets 4,247 - 4,247 -

Financing of customers 24,017,067 - 24,006,413 -

Statutory deposits with

Bank Negara Malaysia 417,091 - 417,091 -

Other financial assets* 17,986 3 17,541 3

30,995,538 225,386 30,981,894 225,386

Commitments and contingencies

Contingent liabilities 1,074,559 - 1,074,559 -

Commitments 1,861,344 - 1,861,344 -

Other Miscellaneous Commitment and

Contingent Liabilities 59,310 - 59,310 -

Islamic derivative financial

instruments 1,786,430 - 1,786,430 -

4,781,643 - 4,781,643 -

Total credit exposures 35,777,181 225,386 35,763,537 225,386

* These balances exclude balances which are not within the scope of MFRS 9, Financial Instruments.

305