Page 303 - Bank-Muamalat_Annual-Report-2023

P. 303

ANNUAL REPORT 2023

OUR NUMBERS

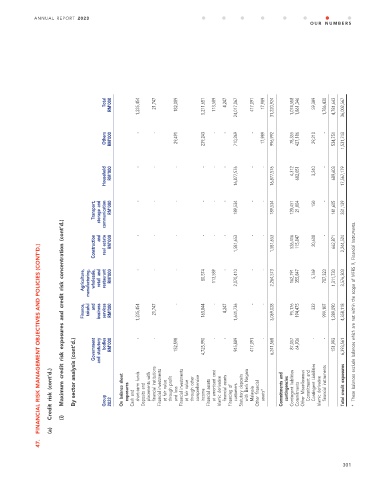

Total RM’000 1,235,454 21,747 182,089 5,211,651 113,589 4,247 24,017,067 417,091 17,989 31,220,924 1,074,558 1,861,346 59,309 1,786,430 4,781,643 36,002,567

Others RM’000 - - 29,491 239,243 - - 710,269 - 17,989 996,992 78,355 427,186 29,210 - 534,751 1,531,743

Household RM’000 - - - - - - 16,877,576 - - 16,877,576 4,312 682,051 3,240 - 689,603 17,567,179

Transport, storage and communication RM’000 - - - - - - 189,534 - - 189,534 120,451 21,004 150 - 141,605 331,139

Maximum credit risk exposures and credit risk concentration (cont’d.)

Construction and real estate RM’000 - - - - - - 1,581,653 - - 1,581,653 526,416 115,847 20,608 - 662,871 2,244,524

FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

Agriculture, manufacturing, wholesale, retail and restaurant RM’000 - - - 80,574 113,589 - 2,070,410 - - 2,264,573 162,791 355,847 5,769 787,323 1,311,730 3,576,303

Finance, takaful and business services RM’000 1,235,454 21,747 - 165,844 - 4,247 1,641,736 - - 3,069,028 95,176 194,475 332 999,107 1,289,090 4,358,118 These balances exclude balances which are not within the scope of MFRS 9, Financial Instruments.

Government and statutory bodies RM’000 - - 152,598 4,725,990 - - 945,889 417,091 - 6,241,568 87,057 64,936 - - 151,993 6,393,561

Credit risk (cont’d.) By sector analysis (cont’d.) Group 2022 On balance sheet exposures Cash and short-term funds Deposits and placements with financial institutions Financial investments at fair value through profit and loss Financial investments at fair value through other comprehensive income Financial assets at amortised cost Islamic derivative financial assets Financing of custom

(a) (i)

47.

301