Page 300 - Bank-Muamalat_Annual-Report-2023

P. 300

BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2023 (18 JAMADIL AKHIR 1445H)

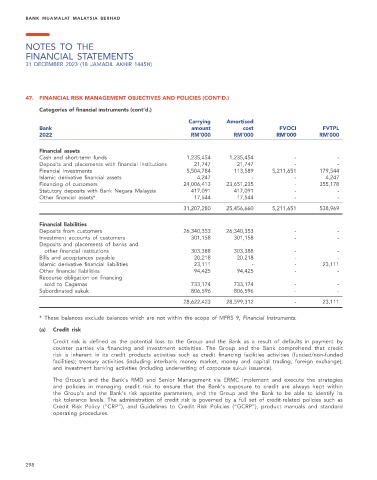

47. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

Categories of financial instruments (cont’d.)

Carrying Amortised

Bank amount cost FVOCI FVTPL

2022 RM’000 RM’000 RM’000 RM’000

Financial assets

Cash and short-term funds 1,235,454 1,235,454 - -

Deposits and placements with financial institutions 21,747 21,747 - -

Financial investments 5,504,784 113,589 5,211,651 179,544

Islamic derivative financial assets 4,247 - - 4,247

Financing of customers 24,006,413 23,651,235 - 355,178

Statutory deposits with Bank Negara Malaysia 417,091 417,091 - -

Other financial assets* 17,544 17,544 - -

31,207,280 25,456,660 5,211,651 538,969

Financial liabilities

Deposits from customers 26,340,353 26,340,353 - -

Investment accounts of customers 301,158 301,158 - -

Deposits and placements of banks and

other financial institutions 303,388 303,388 - -

Bills and acceptances payable 20,218 20,218 - -

Islamic derivative financial liabilities 23,111 - - 23,111

Other financial liabilities 94,425 94,425 - -

Recourse obligation on financing

sold to Cagamas 733,174 733,174 - -

Subordinated sukuk 806,596 806,596 - -

28,622,423 28,599,312 - 23,111

* These balances exclude balances which are not within the scope of MFRS 9, Financial Instruments.

(a) Credit risk

Credit risk is defined as the potential loss to the Group and the Bank as a result of defaults in payment by

counter parties via financing and investment activities. The Group and the Bank comprehend that credit

risk is inherent in its credit products activities such as credit financing facilities activities (funded/non-funded

facilities); treasury activities (including interbank money market, money and capital trading, foreign exchange);

and investment banking activities (including underwriting of corporate sukuk issuance).

The Group’s and the Bank’s RMD and Senior Management via ERMC implement and execute the strategies

and policies in managing credit risk to ensure that the Bank’s exposure to credit are always kept within

the Group’s and the Bank’s risk appetite parameters, and the Group and the Bank to be able to identify its

risk tolerance levels. The administration of credit risk is governed by a full set of credit-related policies such as

Credit Risk Policy (“CRP”), and Guidelines to Credit Risk Policies (“GCRP”), product manuals and standard

operating procedures.

298