Page 298 - Bank-Muamalat_Annual-Report-2023

P. 298

BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2023 (18 JAMADIL AKHIR 1445H)

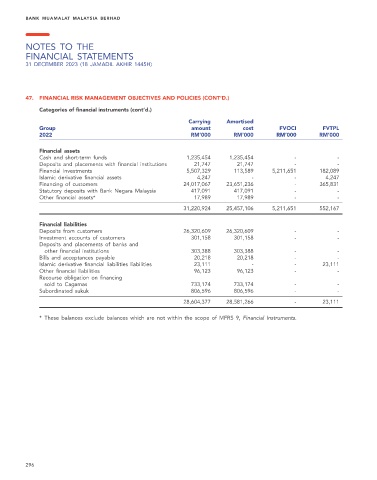

47. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

Categories of financial instruments (cont’d.)

Carrying Amortised

Group amount cost FVOCI FVTPL

2022 RM’000 RM’000 RM’000 RM’000

Financial assets

Cash and short-term funds 1,235,454 1,235,454 - -

Deposits and placements with financial institutions 21,747 21,747 - -

Financial investments 5,507,329 113,589 5,211,651 182,089

Islamic derivative financial assets 4,247 - - 4,247

Financing of customers 24,017,067 23,651,236 - 365,831

Statutory deposits with Bank Negara Malaysia 417,091 417,091 - -

Other financial assets* 17,989 17,989 - -

31,220,924 25,457,106 5,211,651 552,167

Financial liabilities

Deposits from customers 26,320,609 26,320,609 - -

Investment accounts of customers 301,158 301,158 - -

Deposits and placements of banks and

other financial institutions 303,388 303,388 - -

Bills and acceptances payable 20,218 20,218 - -

Islamic derivative financial liabilities liabilities 23,111 - - 23,111

Other financial liabilities 96,123 96,123 - -

Recourse obligation on financing

sold to Cagamas 733,174 733,174 - -

Subordinated sukuk 806,596 806,596 - -

28,604,377 28,581,266 - 23,111

* These balances exclude balances which are not within the scope of MFRS 9, Financial Instruments.

296