Page 294 - Bank-Muamalat_Annual-Report-2023

P. 294

BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2023 (18 JAMADIL AKHIR 1445H)

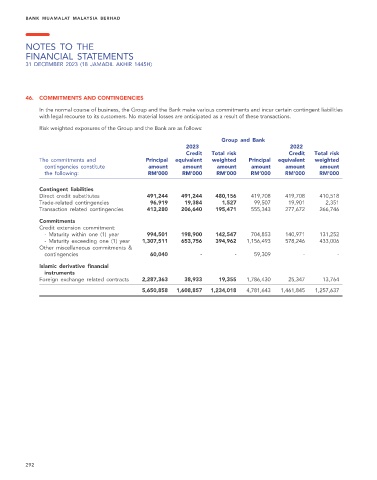

46. COMMITMENTS AND CONTINGENCIES

In the normal course of business, the Group and the Bank make various commitments and incur certain contingent liabilities

with legal recourse to its customers. No material losses are anticipated as a result of these transactions.

Risk weighted exposures of the Group and the Bank are as follows:

Group and Bank

2023 2022

Credit Total risk Credit Total risk

The commitments and Principal equivalent weighted Principal equivalent weighted

contingencies constitute amount amount amount amount amount amount

the following: RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

Contingent liabilities

Direct credit substitutes 491,244 491,244 480,156 419,708 419,708 410,518

Trade-related contingencies 96,919 19,384 1,527 99,507 19,901 2,351

Transaction related contingencies 413,280 206,640 195,471 555,343 277,672 266,746

Commitments

Credit extension commitment:

- Maturity within one (1) year 994,501 198,900 142,547 704,853 140,971 131,252

- Maturity exceeding one (1) year 1,307,511 653,756 394,962 1,156,493 578,246 433,006

Other miscellaneous commitments &

contingencies 60,040 - - 59,309 - -

Islamic derivative financial

instruments

Foreign exchange related contracts 2,287,363 38,933 19,355 1,786,430 25,347 13,764

5,650,858 1,608,857 1,234,018 4,781,643 1,461,845 1,257,637

292