Page 290 - Bank-Muamalat_Annual-Report-2023

P. 290

BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2023 (18 JAMADIL AKHIR 1445H)

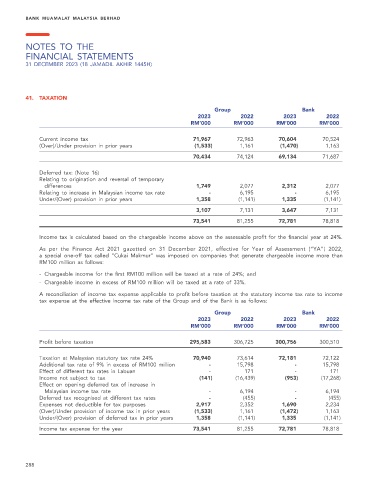

41. TAXATION

Group Bank

2023 2022 2023 2022

RM’000 RM’000 RM’000 RM’000

Current income tax 71,967 72,963 70,604 70,524

(Over)/Under provision in prior years (1,533) 1,161 (1,470) 1,163

70,434 74,124 69,134 71,687

Deferred tax: (Note 16)

Relating to origination and reversal of temporary

differences 1,749 2,077 2,312 2,077

Relating to increase in Malaysian income tax rate - 6,195 - 6,195

Under/(Over) provision in prior years 1,358 (1,141) 1,335 (1,141)

3,107 7,131 3,647 7,131

73,541 81,255 72,781 78,818

Income tax is calculated based on the chargeable income above on the assessable profit for the financial year at 24%.

As per the Finance Act 2021 gazetted on 31 December 2021, effective for Year of Assessment (“YA”) 2022,

a special one-off tax called “Cukai Makmur” was imposed on companies that generate chargeable income more than

RM100 million as follows:

- Chargeable income for the first RM100 million will be taxed at a rate of 24%; and

- Chargeable income in excess of RM100 million will be taxed at a rate of 33%.

A reconciliation of income tax expense applicable to profit before taxation at the statutory income tax rate to income

tax expense at the effective income tax rate of the Group and of the Bank is as follows:

Group Bank

2023 2022 2023 2022

RM’000 RM’000 RM’000 RM’000

Profit before taxation 295,583 306,725 300,756 300,510

Taxation at Malaysian statutory tax rate 24% 70,940 73,614 72,181 72,122

Additional tax rate of 9% in excess of RM100 million - 15,798 - 15,798

Effect of different tax rates in Labuan - 171 - 171

Income not subject to tax (141) (16,439) (953) (17,268)

Effect on opening deferred tax of increase in

Malaysian income tax rate - 6,194 - 6,194

Deferred tax recognised at different tax rates - (455) - (455)

Expenses not deductible for tax purposes 2,917 2,352 1,690 2,234

(Over)/Under provision of income tax in prior years (1,533) 1,161 (1,472) 1,163

Under/(Over) provision of deferred tax in prior years 1,358 (1,141) 1,335 (1,141)

Income tax expense for the year 73,541 81,255 72,781 78,818

288