Page 291 - Bank-Muamalat_Annual-Report-2023

P. 291

ANNUAL REPORT 2023

OUR NUMBERS

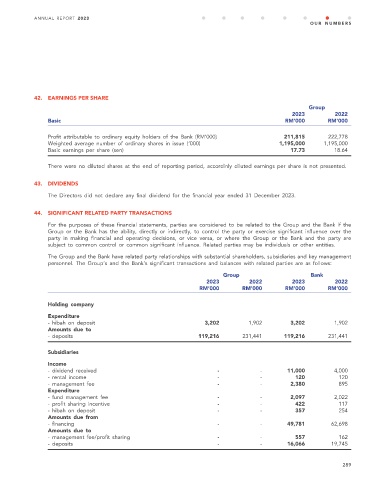

42. EARNINGS PER SHARE

Group

2023 2022

Basic RM’000 RM’000

Profit attributable to ordinary equity holders of the Bank (RM’000) 211,815 222,778

Weighted average number of ordinary shares in issue (‘000) 1,195,000 1,195,000

Basic earnings per share (sen) 17.73 18.64

There were no diluted shares at the end of reporting period, accordinly diluted earnings per share is not presented.

43. DIVIDENDS

The Directors did not declare any final dividend for the financial year ended 31 December 2023.

44. SIGNIFICANT RELATED PARTY TRANSACTIONS

For the purposes of these financial statements, parties are considered to be related to the Group and the Bank if the

Group or the Bank has the ability, directly or indirectly, to control the party or exercise significant influence over the

party in making financial and operating decisions, or vice versa, or where the Group or the Bank and the party are

subject to common control or common significant influence. Related parties may be individuals or other entities.

The Group and the Bank have related party relationships with substantial shareholders, subsidiaries and key management

personnel. The Group’s and the Bank’s significant transactions and balances with related parties are as follows:

Group Bank

2023 2022 2023 2022

RM’000 RM’000 RM’000 RM’000

Holding company

Expenditure

- hibah on deposit 3,202 1,902 3,202 1,902

Amounts due to

- deposits 119,216 231,441 119,216 231,441

Subsidiaries

Income

- dividend received - - 11,000 4,000

- rental income - - 120 120

- management fee - - 2,380 895

Expenditure

- fund management fee - - 2,097 2,022

- profit sharing incentive - - 422 117

- hibah on deposit - - 357 254

Amounts due from

- financing - - 49,781 62,698

Amounts due to

- management fee/profit sharing - - 557 162

- deposits - - 16,066 19,745

289