Page 314 - Bank-Muamalat_Annual-Report-2023

P. 314

BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2023 (18 JAMADIL AKHIR 1445H)

47. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

(a) Credit risk (cont’d.)

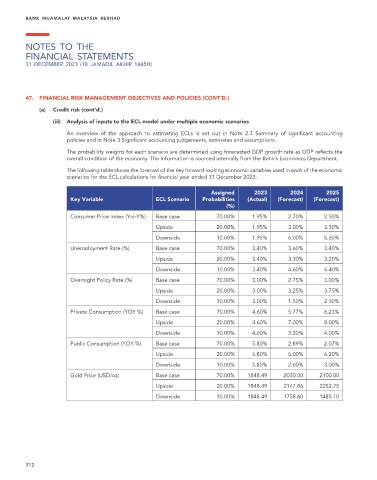

(iii) Analysis of inputs to the ECL model under multiple economic scenarios

An overview of the approach to estimating ECLs is set out in Note 2.3 Summary of significant accounting

policies and in Note 3 Significant accounting judgements, estimates and assumptions.

The probability weights for each scenario are determined using forecasted GDP growth rate as GDP reflects the

overall condition of the economy. The information is sourced internally from the Bank’s Economics Department.

The following table shows the forecast of the key forward-looking economic variables used in each of the economic

scenarios for the ECL calculations for financial year ended 31 December 2023.

Assigned 2023 2024 2025

Key Variable ECL Scenario Probabilities (Actual) (Forecast) (Forecast)

(%)

Consumer Price Index (Y-o-Y%) Base case 70.00% 1.95% 2.70% 2.50%

Upside 20.00% 1.95% 3.00% 3.50%

Downside 10.00% 1.95% 6.00% 5.50%

Unemployment Rate (%) Base case 70.00% 3.40% 3.60% 3.40%

Upside 20.00% 3.40% 3.30% 3.20%

Downside 10.00% 3.40% 4.60% 4.40%

Overnight Policy Rate (%) Base case 70.00% 3.00% 2.75% 3.00%

Upside 20.00% 3.00% 3.25% 3.75%

Downside 10.00% 3.00% 1.50% 2.50%

Private Consumption (YOY %) Base case 70.00% 4.60% 5.77% 6.23%

Upside 20.00% 4.60% 7.00% 8.00%

Downside 10.00% 4.60% 3.30% 4.00%

Public Consumption (YOY %) Base case 70.00% 5.80% 2.89% 2.07%

Upside 20.00% 5.80% 5.00% 6.20%

Downside 10.00% 5.80% 2.60% 3.00%

Gold Price (USD/oz) Base case 70.00% 1848.49 2050.00 2100.00

Upside 20.00% 1848.49 2147.86 2252.75

Downside 10.00% 1848.49 1758.60 1485.10

312