Page 316 - Bank-Muamalat_Annual-Report-2023

P. 316

BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2023 (18 JAMADIL AKHIR 1445H)

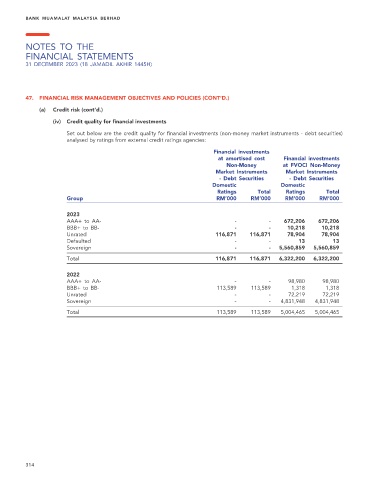

47. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

(a) Credit risk (cont’d.)

(iv) Credit quality for financial investments

Set out below are the credit quality for financial investments (non-money market instruments - debt securities)

analysed by ratings from external credit ratings agencies:

Financial investments

at amortised cost Financial investments

Non-Money at FVOCI Non-Money

Market Instruments Market Instruments

- Debt Securities - Debt Securities

Domestic Domestic

Ratings Total Ratings Total

Group RM’000 RM’000 RM’000 RM’000

2023

AAA+ to AA- - - 672,206 672,206

BBB+ to BB- - - 10,218 10,218

Unrated 116,871 116,871 78,904 78,904

Defaulted - - 13 13

Sovereign - - 5,560,859 5,560,859

Total 116,871 116,871 6,322,200 6,322,200

2022

AAA+ to AA- - - 98,980 98,980

BBB+ to BB- 113,589 113,589 1,318 1,318

Unrated - - 72,219 72,219

Sovereign - - 4,831,948 4,831,948

Total 113,589 113,589 5,004,465 5,004,465

314