Page 31 - Bank-Muamalat-Annual-Report-2021

P. 31

ANNUAL REPORT 2021 29

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

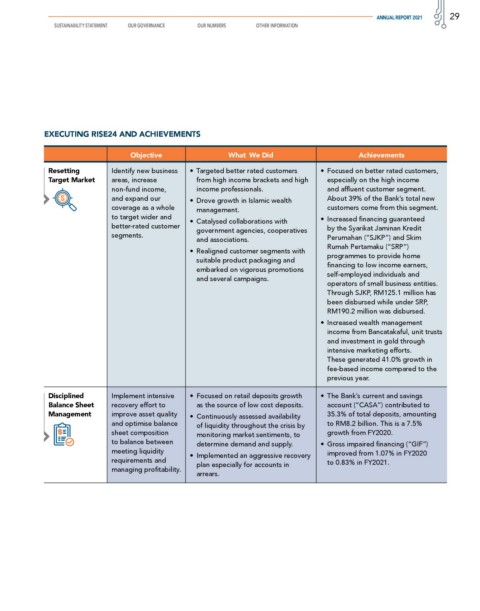

EXECUTING RISE24 AND ACHIEVEMENTS

Objective What We Did Achievements

Resetting Identify new business • Targeted better rated customers • Focused on better rated customers,

Target Market areas, increase from high income brackets and high especially on the high income

non-fund income, income professionals. and affluent customer segment.

and expand our • Drove growth in Islamic wealth About 39% of the Bank’s total new

coverage as a whole management. customers come from this segment.

to target wider and • Increased financing guaranteed

• Catalysed collaborations with

better-rated customer by the Syarikat Jaminan Kredit

government agencies, cooperatives

segments. Perumahan (“SJKP”) and Skim

and associations.

Rumah Pertamaku (“SRP”)

• Realigned customer segments with

programmes to provide home

suitable product packaging and

financing to low income earners,

embarked on vigorous promotions

self-employed individuals and

and several campaigns.

operators of small business entities.

Through SJKP, RM125.1 million has

been disbursed while under SRP,

RM190.2 million was disbursed.

• Increased wealth management

income from Bancatakaful, unit trusts

and investment in gold through

intensive marketing efforts.

These generated 41.0% growth in

fee-based income compared to the

previous year.

Disciplined Implement intensive • Focused on retail deposits growth • The Bank’s current and savings

Balance Sheet recovery effort to as the source of low cost deposits. account (“CASA”) contributed to

Management improve asset quality • Continuously assessed availability 35.3% of total deposits, amounting

and optimise balance of liquidity throughout the crisis by to RM8.2 billion. This is a 7.5%

sheet composition monitoring market sentiments, to growth from FY2020.

to balance between determine demand and supply. • Gross impaired financing (“GIF”)

meeting liquidity improved from 1.07% in FY2020

• Implemented an aggressive recovery

requirements and to 0.83% in FY2021.

plan especially for accounts in

managing profitability.

arrears.