Page 264 - Bank-Muamalat-AR2020

P. 264

262 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

Notes to the fiNaNcial statemeNts

31 December 2020 (16 JamaDil awal 1442h)

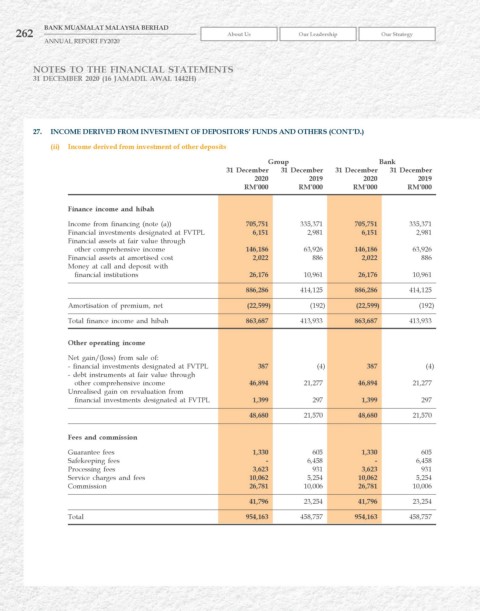

27. INCOME DErIvED FrOM INvESTMENT OF DEPOSITOrS’ FuNDS AND OThErS (CONT’D.)

(ii) Income derived from investment of other deposits

Group Bank

31 December 31 December 31 December 31 December

2020 2019 2020 2019

rM’000 rM’000 rM’000 rM’000

Finance income and hibah

Income from financing (note (a)) 705,751 335,371 705,751 335,371

Financial investments designated at FVTPL 6,151 2,981 6,151 2,981

Financial assets at fair value through

other comprehensive income 146,186 63,926 146,186 63,926

Financial assets at amortised cost 2,022 886 2,022 886

Money at call and deposit with

financial institutions 26,176 10,961 26,176 10,961

886,286 414,125 886,286 414,125

Amortisation of premium, net (22,599) (192) (22,599) (192)

Total finance income and hibah 863,687 413,933 863,687 413,933

Other operating income

Net gain/(loss) from sale of:

- financial investments designated at FVTPL 387 (4) 387 (4)

- debt instruments at fair value through

other comprehensive income 46,894 21,277 46,894 21,277

Unrealised gain on revaluation from

financial investments designated at FVTPL 1,399 297 1,399 297

48,680 21,570 48,680 21,570

Fees and commission

Guarantee fees 1,330 605 1,330 605

Safekeeping fees - 6,458 - 6,458

Processing fees 3,623 931 3,623 931

Service charges and fees 10,062 5,254 10,062 5,254

Commission 26,781 10,006 26,781 10,006

41,796 23,254 41,796 23,254

Total 954,163 458,757 954,163 458,757