Page 260 - Bank-Muamalat-AR2020

P. 260

258 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

Notes to the fiNaNcial statemeNts

31 December 2020 (16 JamaDil awal 1442h)

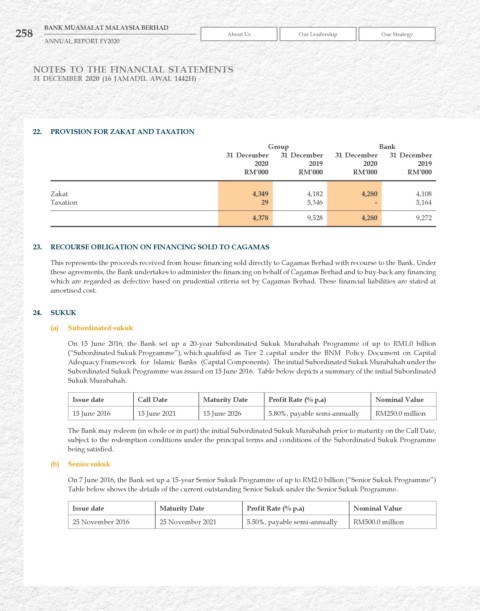

22. PrOvISION FOr ZAkAT AND TAxATION

Group Bank

31 December 31 December 31 December 31 December

2020 2019 2020 2019

rM’000 rM’000 rM’000 rM’000

Zakat 4,349 4,182 4,280 4,108

Taxation 29 5,346 - 5,164

4,378 9,528 4,280 9,272

23. rECOurSE OBLIGATION ON FINANCING SOLD TO CAGAMAS

This represents the proceeds received from house financing sold directly to Cagamas Berhad with recourse to the Bank. Under

these agreements, the Bank undertakes to administer the financing on behalf of Cagamas Berhad and to buy-back any financing

which are regarded as defective based on prudential criteria set by Cagamas Berhad. These financial liabilities are stated at

amortised cost.

24. Sukuk

(a) Subordinated sukuk

On 15 June 2016, the Bank set up a 20-year Subordinated Sukuk Murabahah Programme of up to RM1.0 billion

(“Subordinated Sukuk Programme”), which qualified as Tier 2 capital under the BNM Policy Document on Capital

Adequacy Framework for Islamic Banks (Capital Components). The initial Subordinated Sukuk Murabahah under the

Subordinated Sukuk Programme was issued on 15 June 2016. Table below depicts a summary of the initial Subordinated

Sukuk Murabahah.

Issue date Call Date Maturity Date Profit rate (% p.a) Nominal value

15 June 2016 15 June 2021 15 June 2026 5.80%, payable semi-annually RM250.0 million

The Bank may redeem (in whole or in part) the initial Subordinated Sukuk Murabahah prior to maturity on the Call Date,

subject to the redemption conditions under the principal terms and conditions of the Subordinated Sukuk Programme

being satisfied.

(b) Senior sukuk

On 7 June 2016, the Bank set up a 15-year Senior Sukuk Programme of up to RM2.0 billion (“Senior Sukuk Programme”)

Table below shows the details of the current outstanding Senior Sukuk under the Senior Sukuk Programme.

Issue date Maturity Date Profit rate (% p.a) Nominal value

25 November 2016 25 November 2021 5.50%, payable semi-annually RM500.0 million