Page 265 - Bank-Muamalat-AR2020

P. 265

263

Our Performance Sustainability Statement Governance Our Numbers Other Information

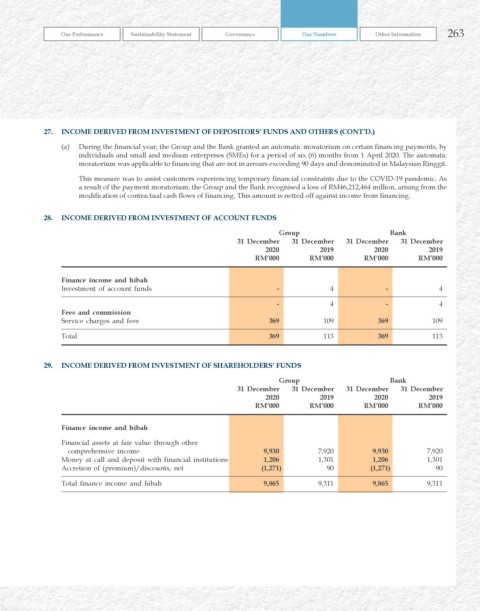

27. INCOME DErIvED FrOM INvESTMENT OF DEPOSITOrS’ FuNDS AND OThErS (CONT’D.)

(a) During the financial year, the Group and the Bank granted an automatic moratorium on certain financing payments, by

individuals and small and medium enterprises (SMEs) for a period of six (6) months from 1 April 2020. The automatic

moratorium was applicable to financing that are not in arrears exceeding 90 days and denominated in Malaysian Ringgit.

This measure was to assist customers experiencing temporary financial constraints due to the COVID-19 pandemic. As

a result of the payment moratorium, the Group and the Bank recognised a loss of RM46,212,464 million, arising from the

modification of contractual cash flows of financing. This amount is netted off against income from financing.

28. INCOME DErIvED FrOM INvESTMENT OF ACCOuNT FuNDS

Group Bank

31 December 31 December 31 December 31 December

2020 2019 2020 2019

rM’000 rM’000 rM’000 rM’000

Finance income and hibah

Investment of account funds - 4 - 4

- 4 - 4

Fees and commission

Service charges and fees 369 109 369 109

Total 369 113 369 113

29. INCOME DErIvED FrOM INvESTMENT OF ShArEhOLDErS’ FuNDS

Group Bank

31 December 31 December 31 December 31 December

2020 2019 2020 2019

rM’000 rM’000 rM’000 rM’000

Finance income and hibah

Financial assets at fair value through other

comprehensive income 9,930 7,920 9,930 7,920

Money at call and deposit with financial institutions 1,206 1,301 1,206 1,301

Accretion of (premium)/discounts, net (1,271) 90 (1,271) 90

Total finance income and hibah 9,865 9,311 9,865 9,311